|

| http://en.wikipedia.org/wiki/File:Siege_perilleux_galaad.jpg |

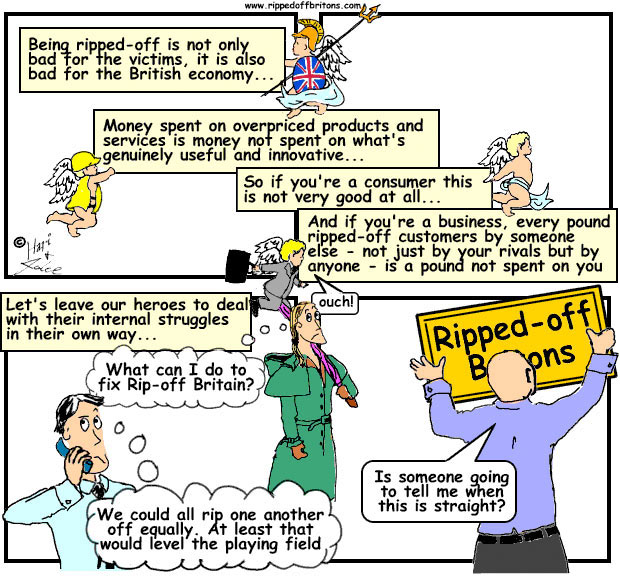

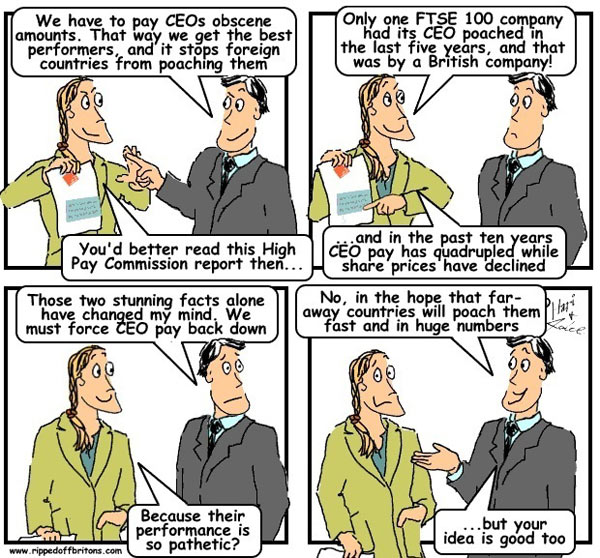

Every bank, insurance company and investment firm covets a noble or two to adorn its board. What could possibly go wrong if a peer of the realm is at the helm?

It is not just financial services. Lords and ladies, knights and dames grace the boards and regulators of electricity, transport, education, health, and just about every major commercial endeavour. Judge them not by their fruits, but by their titles.

To recognise these valiant men and women who fearlessly take responsibility for our nation's well being, ensuring the good and chivalrous behaviour of their companies and those they regulate. In praise of these goodly citizens who use their bodies, minds and reputations as buttresses against all the unseemly pillaging and ripping-off, we give you an excerpt from Monty Python's tale of Camelot:

Brave Sir Robin ran away.

Bravely ran away, away!

When danger reared its ugly head,

He bravely turned his tail and fled.

Yes, brave Sir Robin turned about

And gallantly he chickened out.

Bravely taking to his feet

He beat a very brave retreat,

Bravest of the brave, Sir Robin!