Posted by Hari on Thursday, July 05, 2012 with 5 comments | Labels: Bank of England, banks, British Bankers Assoc, credit crunch, FSA, inequality, pensions, regulation

Riposte: an occasional series that responds to the comments

posted by those who don’t like what we’re saying.

Inevitably, some of the questions overlap. We apologise for

any repetition in the answers.

Here are the comments...

- “Banks pay £55bn in taxes. We’ll lose that if the banks leave the UK!”

- “Regulation will shrink the banking sector, losing jobs and tax revenue. What will replace it?”

- “A lot of other sectors depend on banking: legal services, consulting, and all those shops and restaurants in the city. They will suffer too.”

- “The UK earns £40bn in foreign exchange from overseas. If banks leave, we’ll lose that. The costs of squeezing the banks outweigh the benefits.”

- “Regulation won’t work. The banks will always find ways around it.”

- “The banks were de-regulated in the 1980s, but there were big banking crises before then when regulation was stiffer. So regulation won’t stop banking crises.”

- “Stiffer regulation means we lose our place as the global leader in banking.”

Here are the answers...

Q. Banks pay £55bn in taxes. We’ll lose that if the banks leave the UK!

We’ll only lose £3bn.

That £55bn figure for 2009-2010 includes corporation tax

(£6bn), payroll taxes (£25bn), other business taxes like VAT and rates (£11bn),

other taxes like stamp duty and interest rate tax (£13bn). In April 2011 the Independent

Commission on Banking predicted just £3bn in taxes will be lost if banks relocate. Most UK banking activity makes

its money from the UK domestic market, so only some banking activities can

actually leave, which means most of the money the UK gets in taxes will remain

here.

Money we previously spent on banking will not simply stay in British consumer pockets. It will be spent on other parts of the economy, creating new jobs and new tax revenues.

This is a vitally important point. If the financial sector

shrinks, other parts of the economy will surely grow. This is because banking

falls into the category of an essential

service. Turn it round: if and when essential services like banking,

utilities, water, telecoms and transport raise their prices then other parts of

the economy immediately shrink. Why? Because the money we once spent on

non-essentials like extra clothes, nights out, and the money spent by a business on its othe expenses, will have to be spent on these essential services – we’d have no

choice. No one can avoid spending money on essential services, unlike

non-essential good that we simply stop buying if their prices rise too high. Therefore,

overpriced essential services place a lid on other sectors of the economy in a

way over-priced non-essentials don’t. That is why essential service sectors are all regulated (although not always properly!) and, in some cases, their pricing is enforced.

How much money are we talking about? One consequence of

proper regulation will be to increase competition between banks and reduce

their fees. Currently, banks overcharge us due to poor competition, costing us

billions.

Here are just three examples that directly hit the pockets of

virtually every citizen:

- Savings and pensions: Retail

banking makes £12bn by “trapping” people in poor low-interest savings

accounts (this was happening well before the current credit crunch’s low

interest rates).

http://www.telegraph.co.uk/finance/personalfinance/8087165/Average-saver-losing-out-on-322-a-year.html - Pension fees: Dutch and US

pensions pay out 50% more for the same amount invested solely due to their

lower fees. A very modest UK pension pot of £250k will pay us only £8k per

annum. With lower fees all pensioners will have extra thousands per annum

to spend. This will also go some way to solving all our pension problems.

http://www.telegraph.co.uk/finance/personalfinance/pensions/7921505/American-savers-have-smaller-charges-on-personal-pensions.html

http://www.telegraph.co.uk/finance/personalfinance/pensions/7921524/Charges-and-fees-cutting-50-per-cent-from-British-savers-pension-pots.html - It costs the taxpayer £50bn a year to insure our poorly regulated banks against failure, according to the Bank of England.

These are just three well documented rip-offs that are

perfectly legal. For illegal rip-offs where the banks got caught see “Regulation won’t work. The banks will

always find ways around it” below. End these rip-offs and this money will

be spent on other parts of the economy, generating new jobs and new tax revenue.

What is the size of our financial services industry? For

2010 the total contribution of banks to the UK is: jobs=3.6%; Gross Value Add=8.9%

(peaking at 10% in 2009).

For comparison, manufacturing’s contribution is: jobs=8%; Gross Value Add=10%.

“The financial sector’s contribution to the UK economy” – House of Commons Library, SN06193

“The financial sector’s contribution to the UK economy” – House of Commons Library, SN06193

Note that the number of people employed in financial

services has stuck at around 1m since 1991. It is not the job creator that they want us to

think it is.

Q. A lot of other sectors depend on banking: legal services, consulting, and all those shops and restaurants in the city. They will suffer too.

The money we don’t spend on overpriced banking services will be spent elsewhere: it won’t just sit in our pockets. Leisure? Education? A new kitchen? These are all industries ready to take our money and add real value.

So other supporting sectors and unrelated sectors can continue

and some will grow. Legal and consulting may shrink permanently.

Overpriced rip-off banking services stopped us spending our money

on, and creating jobs in, other parts of the economy. The banking crisis has

now added a huge cost on top of that. Already, as a result of the credit crisis

alone, the banks have cost us around £130bn in direct bank bailouts and £375bn

(as of July 2012) in Quantitative Easing (i.e. printing money). Estimates of

the total cost of “supporting” the banking sector (including borrowing

guarantees and liquidity support, as well as depositor savings protection)

range from £300bn to £850bn. This total figure includes guarantees to support

the banks, so varies depending on their health at any one time. Stiffer

regulation will mean not having to bear all that cost again.

Overpriced rip-off banking services stopped us spending our money

on, and creating jobs in, other parts of the economy. The banking crisis has

now added a huge cost on top of that. Already, as a result of the credit crisis

alone, the banks have cost us around £130bn in direct bank bailouts and £375bn

(as of July 2012) in Quantitative Easing (i.e. printing money). Estimates of

the total cost of “supporting” the banking sector (including borrowing

guarantees and liquidity support, as well as depositor savings protection)

range from £300bn to £850bn. This total figure includes guarantees to support

the banks, so varies depending on their health at any one time. Stiffer

regulation will mean not having to bear all that cost again.

Finally, the Bank of England estimates that taxpayers have

always paid a £50bn “insurance policy” subsidy every year to insure the banks against collapse.

It is difficult to see how they could ever generate a profit without this taxpayer

subsidy.

http://www.guardian.co.uk/business/2009/dec/04/bailout-bank-national-audit-office-report

http://www.guardian.co.uk/politics/reality-check-with-polly-curtis/2011/sep/12/reality-check-banking-bailout

http://www.bbc.co.uk/news/mobile/business-12022260

http://www.guardian.co.uk/politics/reality-check-with-polly-curtis/2011/sep/12/reality-check-banking-bailout

http://www.bbc.co.uk/news/mobile/business-12022260

Q. The UK earns £40bn in foreign exchange from overseas. If banking shrinks, we’ll lose that. No other UK sector is able to earn that amount of valuable foreign exchange.

It costs the taxpayer £50bn a year to insure the banks against failure, according to the Bank of England (BBC explanation here). If we subsidised any other sector with that amount, we’d soon be a global leader in that, earning valuable foreign exchange.

Don’t forget that stiffer regulation will not wipe out the

£40bn in foreign currency earnings via the city, just reduce it.

Q. Regulation won’t work. The banks will always find ways around it.

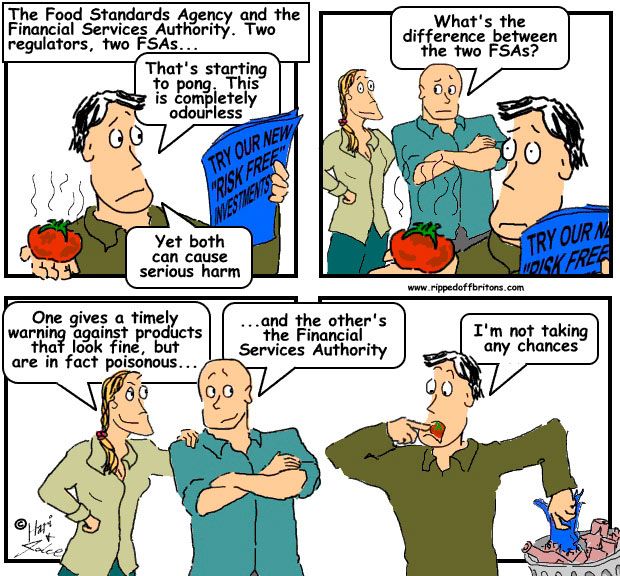

The “policing” side of regulation does work; not often, not always, and not fast enough, but that’s a reason to improve it.

Here are just a few examples:

- Payment Protection Insurance was sold alongside financial products often without the customers' knowledge, and often to people who could never ever claim on it. Following a battle in the courts that ended in May 2011 the banks were forced to agree to return up to £9bn to its customers.

- The banks were forced to pay £13bn in compensation for pension mis-selling up to 1998, and at least £2.7bn for the mortgage endowment scandal of the 1980-90s.

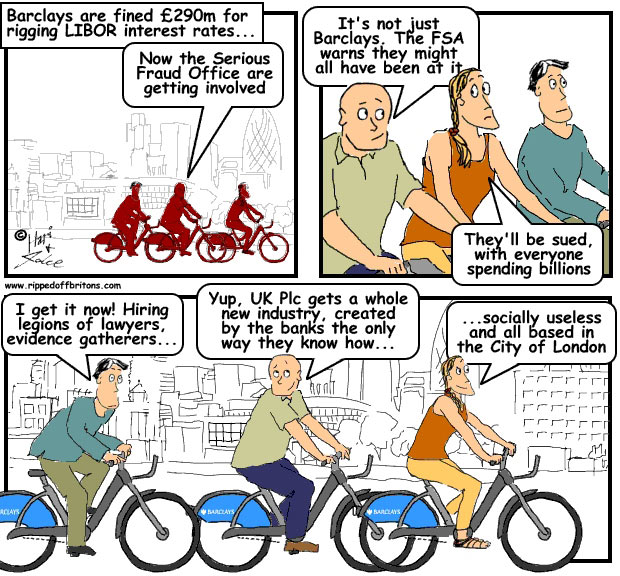

- This month Barclays got caught rigging the LIBOR inter-bank lending rates, and the regulator has already said other banks were too. This interest rate affects us all, and the total cost is yet to be estimated.

- Lloyds Bank, RBS, Barclays and HSBC got caught mis-selling complex IRSA insurance products to tens of thousands of small businesses that can and do put them out of business.

Note that all these big rip-offs were unearthed after the

banking crisis, as if the regulators and the government (both Labour and

Coalition) didn’t have the guts to do anything when the funny money was rolling

in. What’s missing is not decent plans for effective regulation but the will to

use it in good times, not just in bad.

Note that all these big rip-offs were unearthed after the

banking crisis, as if the regulators and the government (both Labour and

Coalition) didn’t have the guts to do anything when the funny money was rolling

in. What’s missing is not decent plans for effective regulation but the will to

use it in good times, not just in bad.Q. The banks were de-regulated in the 1980s, but there were big banking crises before then when regulation was stiffer. So regulation won’t stop banking crises.

Those earlier crises were much smaller than this one.

Try naming one that is nearly as big as this one. The current crisis has needed a direct (i.e.

not including all the other hundreds of billions required to insure banks

against further calamity, print money,

stimulate the economy to soften the recession, etc.) bailout of $700bn in the US,

£130bn in the UK, and Europe’s bailout fund currently stands at around €1

trillion and just keeps on growing. Note that these figures do not include the

cost of shrinking economies, the UK printing £375bn to keep its economy afloat,

etc. etc.

Note that the US Savings & Loans crisis of the late 1980s, costing them $150bn,

came after that sector was deregulated. The Asian Crisis of 1997/8, which

needed an IMF bailout of $40bn, was partly because newly modernising economies

were using old banking regulations.

Anyway, nobody is suggesting proper regulation will stop all

banking crises, only that it will reduce their impact drastically (just as

nobody expects the police to catch all criminals, not doctors to cure all

ills).

Q. Stiffer regulation means we lose our place as the global leader in banking.

We all want the UK to be global leaders in banking, but at the moment we are simply global leaders in the poor regulation of banking.

We could also lead the world in, for example, energy

services and pharmaceuticals by de-regulating those sectors (like we did the

banks in the 1980s) so that they could sell energy that did not exist, or

medicines that cured nothing. But that would not be a good idea.

Just because a business makes money it doesn’t mean that is

always good for UK Plc. Every pound ripped off consumers and businesses is a

pound not spent by them on useful and innovative parts of the economy. When it

is done by an entire sector, and is an essential service like banking, it needs

regulating.

Finally, consider the huge amounts spent by the taxpayer on

insuring the banks against failure, estimated by the Bank of England at a minimum of £50bn a year. If we subsidised any

other sector with that amount, we’d probably soon be a global leader in that.

Brilliant. This is a great example of challenging the cognitive map.

ReplyDeleteWe're told, by bankers and vest interests including politicians, that we can't do with the banks. But it's not true. We can do without casino banking which is more than 90% of what banks do!

We're told that regulation stifles growth and creativity. Growth has declined since deregulation began in 1971. Creativity in banks is clearly a bad thing. We want/need trustworthy, dependable, solid, bankers.

Etc.

Most perniciously we've come to believe that we can't change anything; that there is no alternative. In fact there are a number of alternatives and the people proposing them are not getting the kind of media coverage that the status quo crowd are getting.

You missed out the cost of bailing the banks out. I've heard bankers say "We can't split retail off from investment banks as it would increase fees". Just think how much we pay through taxes.

ReplyDeleteIt's there, under "Q. A lot of other sectors depend on banking: legal services, consulting, and all those shops and restaurants in the city. They will suffer too."

DeleteRather than a list of "What banks are costing us", Riposte is a list of questions commonly asked by "those who don’t like what we’re saying". None of them have ever had the gall so far to say "Banks? They don't cost us that much"

Great! That's the idea.

ReplyDeleteReally useful - the banking world puts up so many smoke screens. Any chance of a list of what regulations have been put in place since the crash?

ReplyDelete