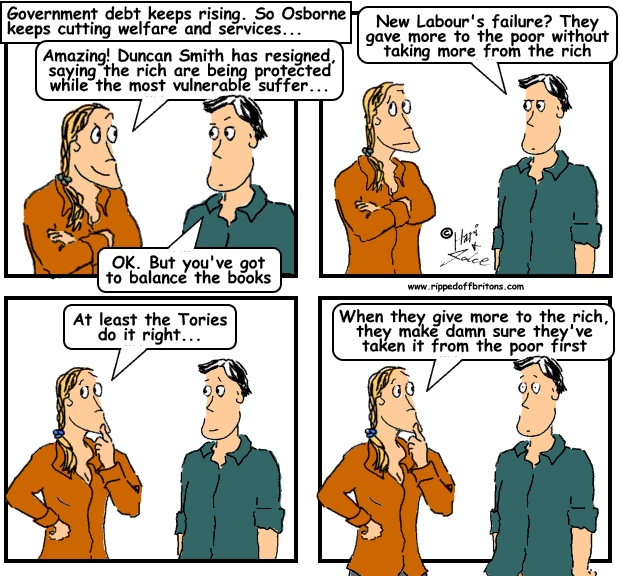

3m poor working families

face losing £2,500 a year from benefit cuts

According to the Institute for Fiscal Studies (IFS) the

freeze in benefit rates and cuts to child tax credit, coupled with the rollout

of universal credit, which has become less generous as a result of changes to

work allowances, signal “large losses” for low-income households. If the cuts

announced in 2015 were fully in place now, nearly 3m working households with

children on tax credits would be an average of £2,500 a year worse off, with

larger families losing more. The scheduled cuts for lower-income families come

alongside tax breaks worth £5bn a year that predominantly benefit middle- and

higher-income households. Although the average impact of tax and benefit

changes since 2015 has been relatively small so far, planned benefit cuts will

reduce government spending by about £15bn a year in the long run, with the

poorest working-age households facing losses of between 4% and 10% of income a

year, the IFS says. The impact of the planned cuts on the poorest working-age

families over the next five years will be much greater than those imposed

during the 2010-15 coalition government. Pensioner households are mostly

protected from future benefit cuts. Tom Waters, a research economist at the

IFS, said: “As suggested by the 2015 Conservative manifesto, the government

have announced income tax cuts that mostly benefit middle- and higher-income

households and working-age benefit cuts that mostly hit lower-income

households. But while the tax cuts have largely already been delivered, most of

the benefit cuts are yet to take effect.” GUARDIAN

NHS needs £25bn in

emergency cash, say NHS leaders

An influential group representing NHS trusts says that the

care provided by hospitals and GP surgeries will suffer over the next few years

unless the prime minister provides an £5bn a year for the next three years –

and a further £10bn of capital for modernising equipment and buildings. NHS

Providers, an association of NHS Foundation Trusts and Trusts, is preparing to

release its own manifesto next week, calling on the Conservatives and Labour to

end what it calls the austerity funding of the health service. Hospitals needed

that £5bn a year to get rid of their deficits of £800m-£900m a year, fulfil new

NHS commitments on cancer and mental health and improve their performance

against key waiting time targets. The NHS also needed a further £10bn for

capital spending on building and repairing premises, buying new equipment and

modernising how care is provided, she added. That is the sum which a recent

report commissioned by the Department of Health said the service needed for

those purposes. A second group, the NHS Confederation, which represents

hospitals and ambulance and mental health services, urged May to commit to

giving the NHS £8bn-a-year annual budget increases after 2020-21, when the

current funding settlement expires. The DH’s budget is due to reach £133.1bn by

March 2021. Niall Dickson, its chief executive, said NHS services were so

stretched that it would have to go back to getting at least the 4%-a-year

budget increases it enjoyed historically between its creation in 1948 and 2010.

After that, the coalition government limited rises to 1% annually. Simon

Stevens, the chief executive of NHS England, has voiced concern that per capita

health funding will decline in 2018-19 and 2019-20. It is due to fall from its

current level of £2,223 a head this year by £16 next year and £7 in 2019. GUARDIAN

McDonald’s offers

fixed contracts to 115,000 UK zero-hours workers

Credit Suisse chief executive Tidjane Thiam and the bank's

board of directors have offered to cut The move is a significant development in

the debate about employee rights because McDonald’s is one of the biggest users

of zero-hours contracts in the country. Sports Direct has also used workers on

zero-hour contracts in its shops. The fast-food chain is to offer fixed-hours

contracts after staff in its restaurants complained they were struggling to get

loans, mortgages and mobile phone contracts because they were not guaranteed

employment each week. Zero-hour contracts are controversial because companies

can use them to exploit workers, offering unpredictable working hours and

changing shifts at short notice. The TUC has called for the government to ban

zero-hours contracts. It has found that staff on these contracts earns a third

less per hour than the average worker. McDonald’s has been trialling the shift

to fixed-hours contracts in 23 sites across the country. The company said that

about 80% of workers in the trial chose to remain on flexible contracts and it

has seen an increase in levels of employee and customer satisfaction after the

offer. Staff have been offered contracts in line with the average hours per

week they work. This includes contracts of either four, eight, 16, 30 or 35

hours a week. The company will initially expand fixed contracts to 50 more

restaurants before rolling it out nationwide to existing and new employees

later this year. Paul Pomroy, the chief executive of McDonald’s UK, said: “The

vast majority of our employees are happy with their flexible contracts, but

some have told us that more fixed hours would help them get better access to

some financial products.” He added: “The hard work of our restaurant teams has

enabled us to deliver 44 consecutive quarters of growth in the UK.” The company

has been targeted by protesters over its treatment of staff. Earlier this

month, campaigners from Fast Food Rights and Better Than Zero dressed as clowns

and demonstrated outside a McDonald’s restaurant in Glasgow over its use of

zero-hours contracts. The TUC has warned that 3.5 million people could be stuck

in insecure work such as zero-hours contracts, agency work or low-paid

self-employment by 2022 – 290,000 more than at present. GUARDIAN

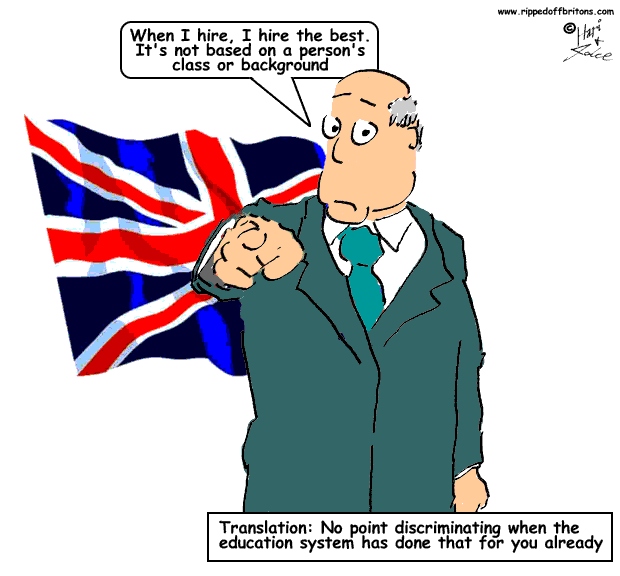

The UK's middle class

remains one of the smallest and poorest in Europe despite having expanded the

most over two decades

The United Kingdom’s middle class has seen one of the

biggest expansions among Western countries over the past two decades but it

remains one of the smallest and least wealthy, new analysis by Pew Research

Centre has shown. To qualify as middle class via Pew's income-based model, a

family of four in the UK would need a cumulative disposable income of between

just over $29,000 and $87,300 (£19,000 - £57,350 in 2010 rates). Among Western

European countries this is the lowest except for Italy’s minimum of $25,000 and

Spain’s $24,500. The study covers the two decades between 1991 and 2010 for

Denmark, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands,

Norway, Spain, the UK and the US. But while middle classes shrunk in seven out

of the 11 countries, including Italy, Germany and Spain, mirroring a long-term

trend in the US, Ireland saw its middle class expand most, followed by the UK. The

report also shows that the UK had the biggest share of people on upper-income

in Europe at 14 per cent, second only to the US (15 per cent). Norway, on the

other hand, had the smallest proportion of population on upper income at 6 per

cent as it also counts the biggest middle class, which makes up 80 per cent of

its population. The Pew said that countries where incomes are more equal have

larger shares of middle-income adults, and vice versa, suggesting that

countries like Norway and Denmark are more equal than countries like the UK and

Italy. For a UK family of four to be defined on ‘upper income’, it would need

to have a cumulative disposable income of around $87,000, compared to Ireland’s

$90,000. That is $43,600 for an individual in the UK, compared to $45,000 in

Ireland. DAILY MAIL

Arrests as Newcastle

and West Ham raided in £5m tax probe

Newcastle's managing director Lee Charnley was among

"several men within professional football" who were arrested. He was

released without charge at about 17:00 BST. HM Revenue and Customs (HMRC)

deployed 180 officers across the UK and France. The BBC understands the

suspected income tax and National Insurance fraud amounts to £5m. HMRC said it

searched premises in the north east and south east of England, and seized

business records, financial records, computers and mobile phones. Newcastle

were promoted to the Premier League on Monday, just 348 days after relegation. According

to its 2015-16 accounts, the club had a turnover of £126m, paid out £75m in

players' wages and recorded pre-tax loss of £4.1m. HMRC raided West Ham's

offices at the London Olympic Stadium where the club moved in August, having

played at Upton Park since 1904. Companies House figures for 2015-16 show it

turned over £142m, paid out £85m in player's wages and made a pre-tax loss of

£4.8m. In January, a Parliamentary Committee revealed 43 players, 12 clubs and

eight agents were the subject of "open inquiries" by HMRC. The Public

Accounts Committee highlighted particular concerns about tax evasion in the

football industry and the "misuse" of image rights to reduce tax

liabilities. BBC NEWS

Barclays boss faces

shareholder revolt over whistleblowing case

Barclays’ chief executive is facing a shareholder revolt at

next month’s annual meeting because of the ongoing regulatory investigation

into his attempts to unmask a whistleblower. Shareholders are being advised to

abstain from the annual vote to re-elect the American banker Jes Staley to the

board by ISS, an influential adviser to major investors, in a sign that the

bank could face a significant protest vote against its chief executive at the

10 May AGM. Staley will be braced for questions about his conduct when the bank

reports its first-quarter results on Friday. He has issued a written apology

for becoming too personally involved in the whistleblowing case, which related

to the conduct of Tim Main, who worked with Staley at US bank JP Morgan and was

then recruited to Barclays in a senior role last June. Both the Financial

Conduct Authority and the Bank of England’s Prudential Regulation Authority are

investigating the matter. Barclays has formally reprimanded Staley and insisted

that there will be a significant reduction in his bonus, which was £1.4m last

year. Not only is it unusual for City regulators to investigate the conduct of

chief executives of major financial institutions, it is also unusual for major

proxy firms to issue advice to abstain against their re-election to the board. GUARDIAN

"GDP" is measuring the

wrong things! Car accidents, poor health and the throw-away society boosts GDP

GDP is seriously messed up. It is often thought of simply as

the most common measurement of the size of a country’s economy – how could that

be controversial? But far from being impartial, GDP considers all sorts of

negative things as good for the economy and ignores other things that are

actually really beneficial. Worse than that, it incentivises governments to

prioritise those negative things at the expense of the positive – and that can

be hugely damaging for a healthy society. Lorenzo Fioramonti is the professor

of political economy at the University of Pretoria, South Africa, and author of

The World After GDP. According to Lorenzo, the perfect GDP Man – someone who

lived to optimise economic growth – would be ‘obese, driving a car to work

every day and stuck in traffic, probably have a serious chronic disease and be

on the verge of a divorce because after a divorce means more fees to lawyers

but also two houses to be bought and one house to sell’. He adds that in theory

to maximise GDP, no one would spend any time with their children and work all

the time instead. That way, there would be two contributions to GDP instead of

none – one of the parent earning money and a second of the carer being paid to

look after their children and then spending their earnings. Furthermore, car

accidents, poor health and destruction boost GDP, while maintaining and keeping

things as they are – such as good health and natural resources - does not. He

points out that the two countries that have seen the strongest GDP growth in

the last few years have been Libya and South Sudan – both of which have

suffered civil wars. DAILY MAIL

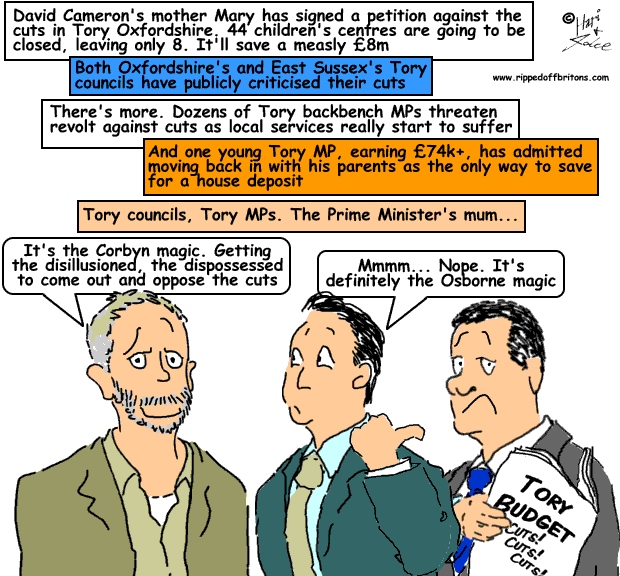

Anger as Tate asks

underpaid staff to contribute towards boat for boss Nicholas Serota

Tate has come under fire after it asked members of staff,

many of whom are not paid the London living wage, to contribute towards a boat

for departing director, Nicholas Serota, just one week after their canteen

discount was taken away. A notice which went up in the staff rooms of both Tate

Modern and Tate Britain on Wednesday asking employees – including security,

cleaners, those maintain the galleries or work in the cafe and gift shop – to

“put money towards a sailing boat” as a “surprise gift” for Serota. The notice

said management had thought “long and hard” about an appropriate gift for the

director, who is leaving in May after 28 years at the Tate. “Nick loves sailing

and this would be a lasting and very special reminder of the high regard which

I know so many of us have for Nick and his contribution to Tate,” the plea for

donations added. The appearance of the notice was a source of anger among

junior staff. The gallery has been embroiled in disputes over low pay and its

decision to outsource a large number of jobs to agency Securitas, which does

not pay the London living wage and pay workers less than those hired directly

by Tate for the same jobs. The notice was still up on Thursday morning but by

lunchtime had been taken down. Tracy Edwards, the PCS Union representative for

Tate staff, said several had contacted her about it, adding that she had

originally thought the notice was a spoof. “The staff at Tate are underpaid

paid and overworked, and haven’t had appropriate pay rises, and this just

demonstrates how divorced from reality the management at Tate are,” she said. A

staff member at Tate, who is hired through Securitas and spoke to the Guardian

on condition of anonymity, spoke of the “disgust” among colleague when they saw

the request for donations. “There was a mixture of shock and laughter,” he

said. “The chasm that exists between upper management and the staff on the

ground is just farcical and this just made it clearer than ever. For us,

Serota’s legacy among staff is one of privatisation and union busting and

turning the Tate into Westfield with pictures.” GUARDIAN