TOP STORIES

-

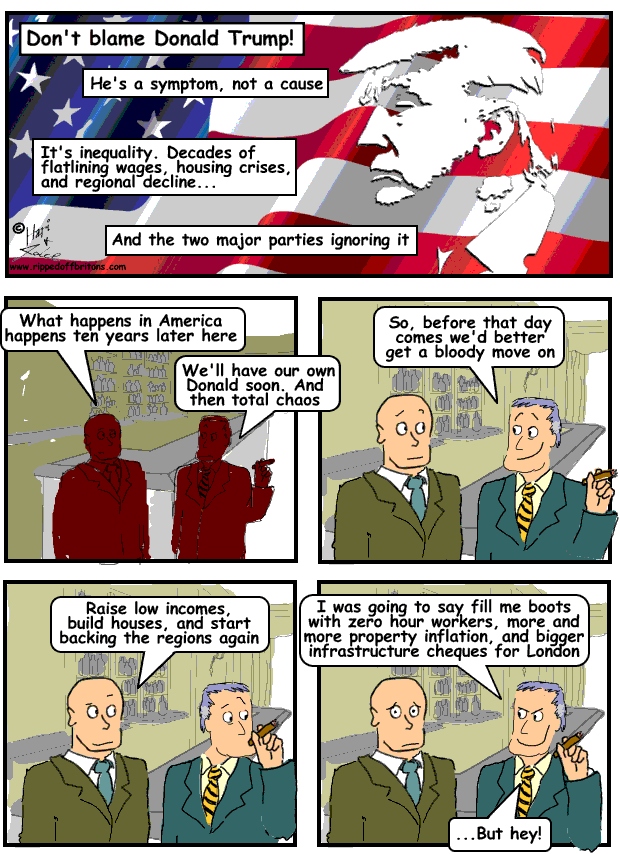

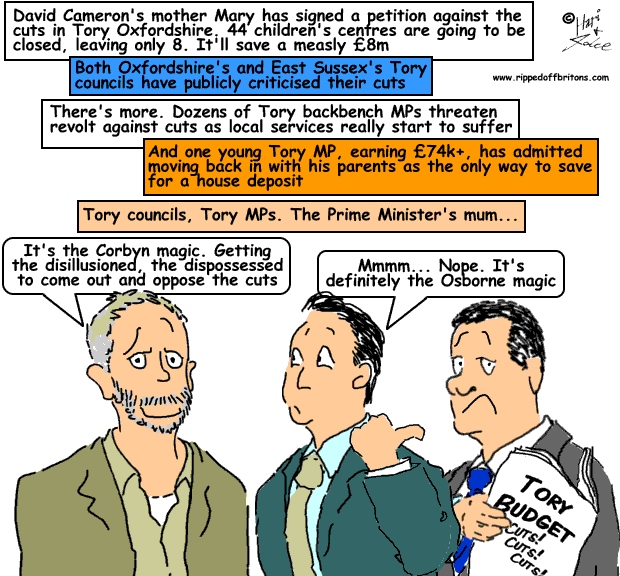

LATEST: Only London and the South East have recovered from the bank crash, says Bank of England director

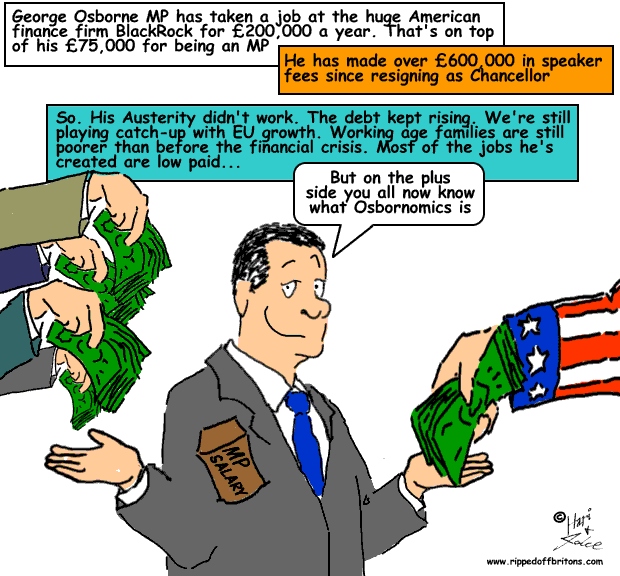

Nor has the "jobs recovery" been a "wages recovery." Well done Cameron and Osborne -

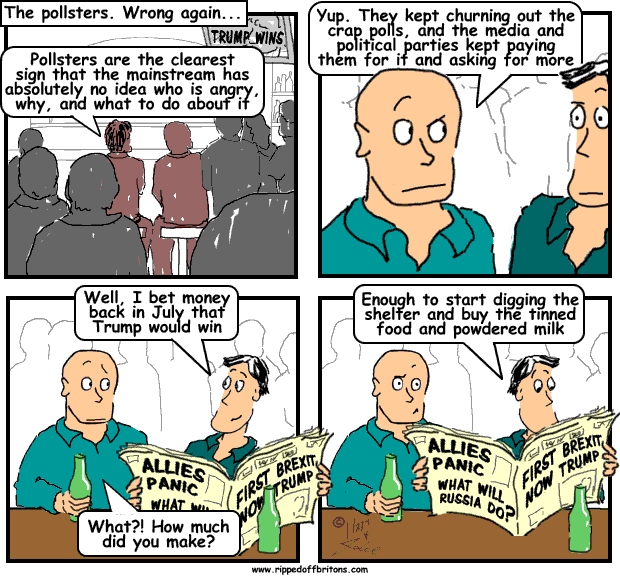

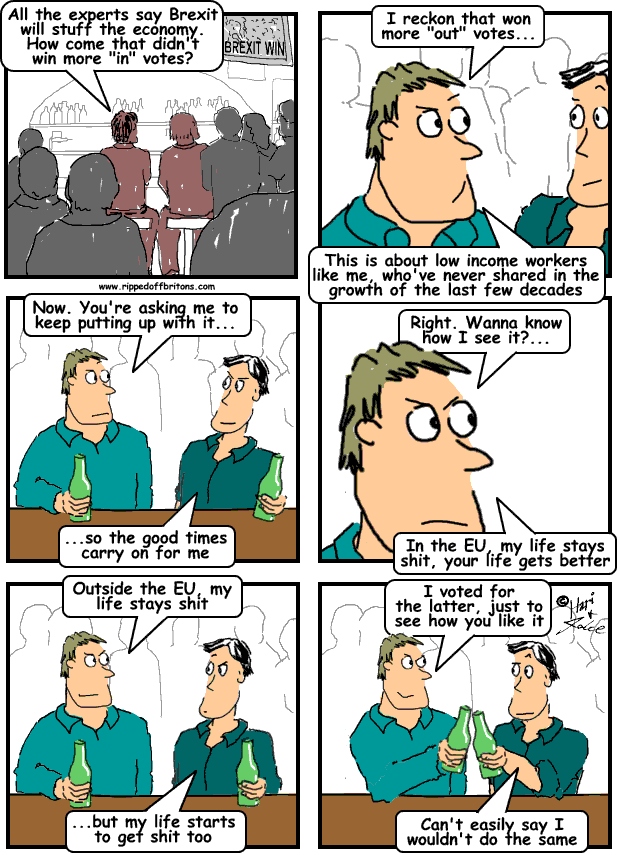

DON'T BE FOOLED: BREXIT was about Inequality not Immigration. Why won't politicians, pundits and social media realise this?

Because blaming racists, or "unpatriotic" internationalists, is so much easier than blaming yourselves -

RIP-OFF NEWS ROUND-UP, OUR PICK OF THE LAST MONTH'S MEDIA

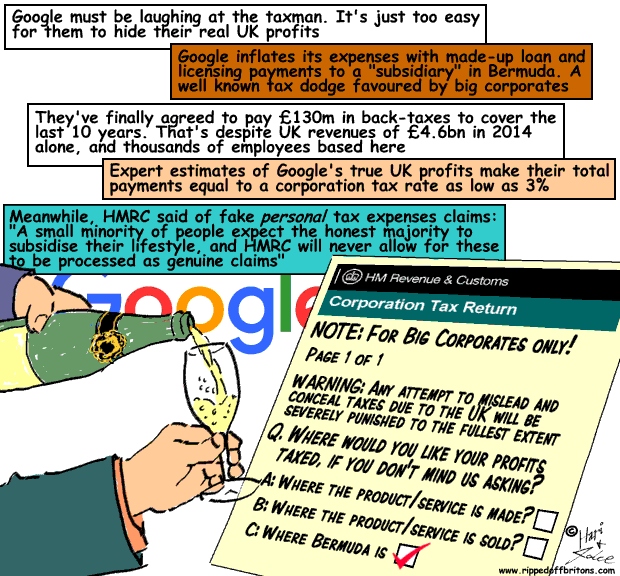

Paradise Papers: Queen and Bono kept money in offshore funds, leaked files reveal

Cameron's former energy minister lands top job at Russian oligarch's metals firm

UK mobile phone firms overcharging customers after contracts expire, +more stories...

-

ELECTION 2020: Since 1997 the percentage of those under 55 who don't vote has doubled

Who Dares (to win them back) Wins -

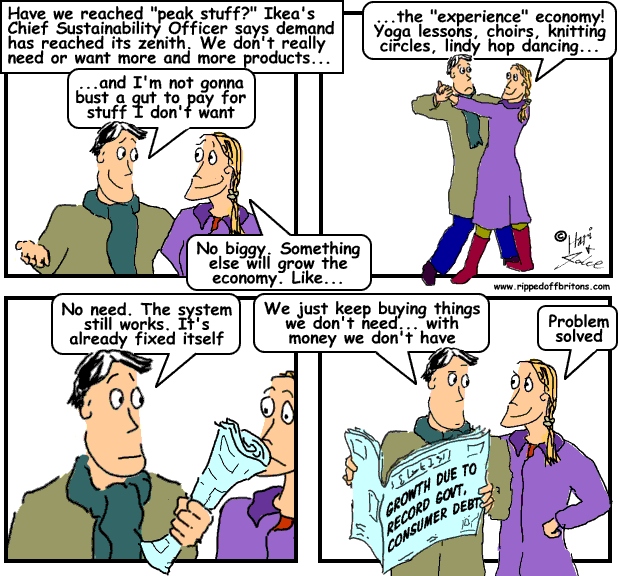

EYE OPENER: The Top 1% are paying more income tax? Because their income has doubled since 1995 while the bottom 90%'s has stagnated

Half of us are borrowing to cover living costs. Since the 1980s the poorest fifth have been borrowing more and more

CARTOONS

Monday 31 January 2011

Sunday 30 January 2011

Rip-offs come in all shapes and sizes:

- Crippling inescapable pilfering that ruin you and offer no hope of recovery. Pensions and investments, with their high charges and low returns, fall into this category, leaving millions spending their final years in reduced and poverty stricken circumstances.

- Discretionary scams, such as purchases of goods and holidays. A few hundred, or thousand, pounds lost on a non-recurring and avoidable ‘low cost’ flight or fridge or time-share holiday home.

- Periodic kicks in the gut, such as servicing your car, and your gas and electricity utility bills. Made more awful by the knowledge that they are coming, and will come again and again.

Of the periodic kicks in the gut, the hardest hitting are utility bills. Rent or mortgage probably costs more, but is predictable. The cost of staying in your home stays the same most of the time, and it turns up on the dot each month. You use your house for a month, and you pay for a month.

But with utility bills everything is fluid. What you pay depends on how much electricity and gas you use, what time of the day you use it, and what the latest cost is. The cost is dependent on whether you pay by meter, by direct debit, by cheque, by paperless billing, by papered billing. And also on the prices of fossil fuels, the projected prices, the cost of the hedging done a year ago to mitigate price risk in the year to come. Which is all highly dependent on the crazies in Venezuela, Iran, Iraq, Saudi Arabia, and whether the Americans wants to test their latest hardware by dropping it on someone somewhere. And, just as importantly, it depends on how much the energy companies want to rip you off.

Ordinary Britons are on the whole painfully reasonable people. If we possibly can, we tend to give the benefit of the doubt and take the pain. The scamsters rely on this. Where there is uncertainty and confusion about the apparent scam there is resigned tolerance. Without a forensic examination we can’t be sure whether that gasp-inducing gas bill was because we left the thermostat too high a month ago. Or if we can do something about the shocking electricity charges by running the washing machine at night during off-peak hours. If at all possible, we put the blame on ourselves – mainly as an excuse for not taking any action against suspected rip-offs.

Wednesday 26 January 2011

Wednesday, January 26, 2011

Posted by Hari

No comments

Labels: banks, British Bankers Assoc, FSA, insurance, OFT, regulation, the courts

Our three heroes, Fee, Chris and KJ, bet on the banks coming out best in the BBA's high court challenge on PPI

Sunday 23 January 2011

Sunday, January 23, 2011

Posted by Jake

4 comments

Labels: Article, Big Society, inequality, public sector

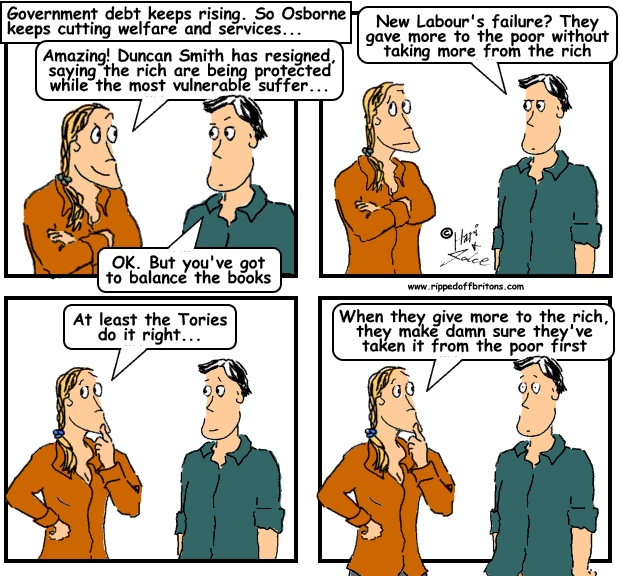

There is a widely held falsehood that the rich subsidise the poor. The poor are poor because they don’t have enough money, and therefore it is supposed that the rich give them handouts via their taxes. There are various fig-leaves to justify this disparity in cashflow. A few truly talented executives justify bumper payrounds for the mediocre herd. And a few truly awful pieces of trash justify the pitiless treatment of all the other poor. But the reasons for who gets what is not my current purpose. My purpose is the question of inequality, subsidies, and public spending cuts.

There is a widely held falsehood that the rich subsidise the poor. The poor are poor because they don’t have enough money, and therefore it is supposed that the rich give them handouts via their taxes. There are various fig-leaves to justify this disparity in cashflow. A few truly talented executives justify bumper payrounds for the mediocre herd. And a few truly awful pieces of trash justify the pitiless treatment of all the other poor. But the reasons for who gets what is not my current purpose. My purpose is the question of inequality, subsidies, and public spending cuts.

Subsidies, including those that come from public spending, are about personal spending, made up of discretionary and mandatory spending. For those who have all the money they can toss around, there is only discretionary spending. They have no need to mandatorily put aside money before they can splash their cash. Even after all the splashing, they have plenty to pay for their housing, health and education.

Next come the less well endowed who have to make crucial budgetary decisions to choose whether or not to take the state subsidies. Whether to buy a new car every two years or pay for private education; whether to spend a few thousand on a family holiday, or take a mortgage to buy a home; whether to purchase the all-encompassing phone-internet-cable tv deal for hundreds of pounds, or buy private health insurance.

And the rest, well, they have no choice but to rely on “subsidies”. Their income is simply not sufficient to pay market rates for those must-have things such as housing, schooling, and doctoring. Hence some of the main “subsidies” in Britain come in the form of the National Health Service, state schools, and social housing. Societies that don’t ensure there is enough money for health, housing and education can be seen all over the world. They are ghastly morasses with all the bad stuff that comes with that, together with strong walls and fierce militias to keep the haves separate from the have-nots.

For countries such as Britain that wish to stay above the morass, the option of actually paying everyone enough not to need subsidy is considered way too expensive. Relying on people to choose would mean paying them enough money to take all the more appealing choices and still have enough left over to pay for the mandatory stuff.

Wednesday 19 January 2011

Wednesday, January 19, 2011

Posted by Hari

No comments

Labels: banks, Bonus, FSA, pay, regulation, series

Sunday 16 January 2011

Sunday, January 16, 2011

Posted by Jake

No comments

Labels: Article, banks, Bonus, pay, pensions, taxation

The City operates like the feudal barons of the middle ages, who oppressively taxed their peasants but once a year would give away a roasted ox at the village fete. The dimmer citizens would be greatly appreciative of this annual generosity, forgetting that it was paid for by the oppressive taxes imposed by the generous barons. In the twenty odd years that bankers started robbing their own banks by carting out cash in bonus-bags, politicians - in a state of distracted incomprehension - have claimed that the banks should be allowed to make profit because they contribute so much tax. But lets look at the figures here.

In a press release in October 2010, Which?, the consumer magazine, reported "Savers are missing out on £12 billion a year by keeping their money in accounts that pay miserly rates, according to new Which? research."

With this single scam reported by Which?, UK banks cover virtually the entire the cost of their corporation tax. This lets them pocket the proceeds of all their other excessive charges (e.g. pension fund charges) and penalties (e.g. unauthorised overdrafts).

With this single scam reported by Which?, UK banks cover virtually the entire the cost of their corporation tax. This lets them pocket the proceeds of all their other excessive charges (e.g. pension fund charges) and penalties (e.g. unauthorised overdrafts).

Wednesday 12 January 2011

Wednesday, January 12, 2011

Posted by Hari

No comments

Labels: benefits, inequality, series, taxation

Sunday 9 January 2011

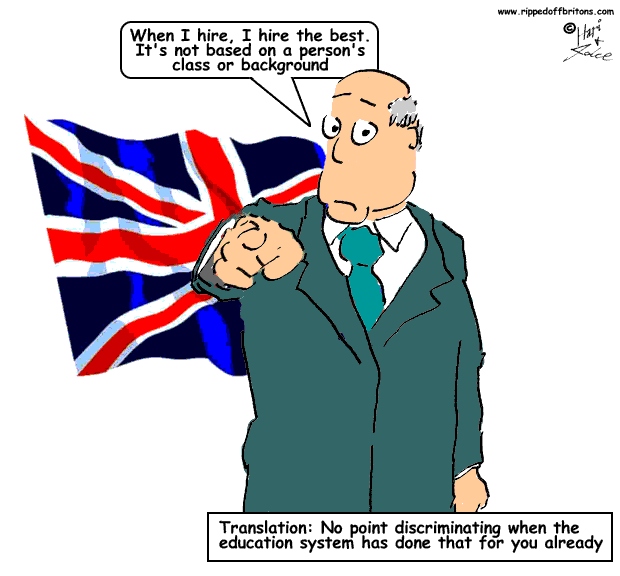

The ‘tussle for talent’ is the favourite justification given by companies, bureaucracies, and parliaments for generous perks, privileges, and pay. To say the “talent” takes the credit is obvious – that is how they are identified as “talent”. However, whether they deserve all the credit they take is a matter of opinion.

The ‘tussle for talent’ is the favourite justification given by companies, bureaucracies, and parliaments for generous perks, privileges, and pay. To say the “talent” takes the credit is obvious – that is how they are identified as “talent”. However, whether they deserve all the credit they take is a matter of opinion.

The people who allocate the ‘credit’, and thereby define who the ‘talent’ is, are the bosses of organisations. A report released in October 2010 by Income Data Services demonstrates that the bosses are sure of one thing – they themselves are enormously talented, and they tussle vigorously to reward themselves. In a time when wages are generally stagnating, the bosses determination to tussle for their own talent is evident:

Even boosting the pay of fellow employees, by declaring how talented they are, is not always a matter of generosity or admiration – it can also be to provide a smokescreen. Massive rewards to bankers distracts attention from even more massive rewards to banking bosses. The bankers may be wolves in sheep’s clothing, but in that galloping herd of talented sheepskins there are many sheep in sheep’s clothing getting away with gratifying levels of pay and perks. The degree to which this smokescreen has worked can be seen from the fact that in the years between 1980 and 2007 the pay per worker in the financial sector – i.e. all of them, not just the “talent” – rose from about par to over 1.8 times the average pay per worker. These figures on pay are from the US, which the UK strives to match.

Saturday 1 January 2011

Saturday, January 01, 2011

Posted by Jake

1 comment

Labels: Article, banks, Bonus, FSA, pay, regulation, taxation, Vince

“And, being fed by us, you used us so

As that ungentle gull, the cuckoo's bird,

Useth the sparrow--did oppress our nest”

William Shakespeare, King Henry the Fourth, Part I

Money is the key to releasing all the skills and assets in a nation. Which is why those who manage the flow of money, the bankers and financial traders, have been able to enrich themselves in a way no other non-criminal profession has. Possession, after all, is nine tenths of the law. And once you’ve put your money into a bank or an investment, it is de facto in the possession of the banker.

You can do a lot of things with money. In fact, that is the entire point of money – you can do a lot of things with it. Money, after all, is the physical manifestation of liquidity. The economy is ultimately based on people exchanging goods and services produced by their own labour and assets for goods and services produced by other people’s labour and assets. Money is nothing more than the token used to conduct this exchange.

If money didn’t exist, the only way a carpenter could get his teeth fixed would be by finding a dentist who happened to need some carpentering. The carpenter would build the dentist some shelves, and in return, the dentist would fix the carpenter’s teeth. The dentist too would only be able to employ those tradesmen who happened to have a toothache. All our skilled carpenters, bakers, butchers, doctors, dentists, computer programmers, and everyone else would spend virtually all their time finding a counter-party who not only needed their particular skill but could also provide the particular skill they needed in exchange. And have very little time left to use their actual skills. Imagine, if the dentist’s house was burning down and the fire truck arrived, only those firemen with bad teeth would take the trouble to fight the flames!

Under these circumstances, the only way to have a Rapid Response fire brigade would be to have literally thousands of firemen waiting at the station. When there is a fire at, say, a butcher’s shop, it would require a show of hands of those fancying a pork chop for dinner to raise a crew.

Money is the token that enables people to offer their skills to anyone with money. The dentist pays the fireman, through his taxes, with money – so even those fire fighters with good teeth will save his house, chattels, and loved ones. The dentist fixes the teeth of tradesmen he has no need of, providing his dentistry skills in exchange for their money. And he uses that money to pay for, among other things, his taxes which makes sure firemen are available regardless of the state of their molars.

Follow Us

Search Us

Trending

Labels

advertising

Article

Austerity

Bank of England

banks

benefits

Big Society

BIJ

Bonus

Brexit

British Bankers Assoc

budget cuts

Cameron

CBI

Clegg

Comment

credit crunch

defence

education

elections

energy

environment

executive

expense fraud

FCA

FFS

FSA

Gove

Graphs

Guest

HMRC

housing

immigration

inequality

Inflation

insurance

jobs

Labour

leisure

LibDems

Liebrary

Manufacturing

media

Miliband

MP

NHS

OFCOM

Offshore

OFGEM

OFT

Osborne

outsourcing

pay

pensions

pharma

police

politicians

Poll

property

protests

public sector

Puppets

regulation

retailers

Roundup

sales techniques

series

SFO

Shares

sports

supermarkets

taxation

Telecoms

the courts

the government

tobacco

Tories

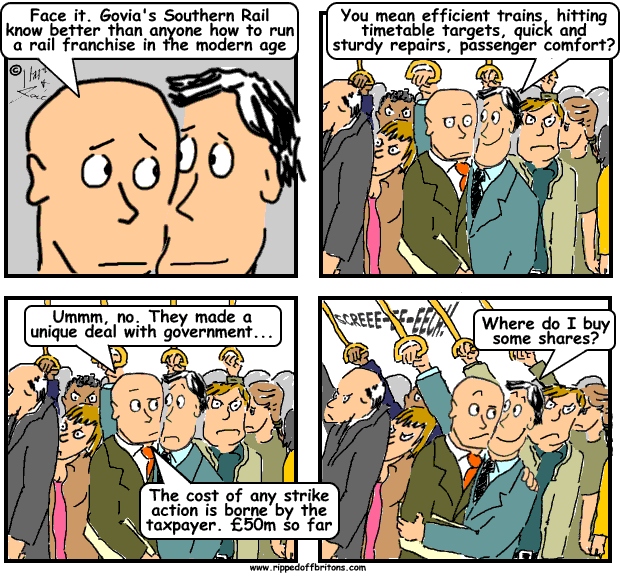

transport

TUC

UK Uncut

unions

Vince

water

Archive

-

▼

2011

(178)

-

▼

January

(16)

- NHS reforms: is there a doctor on board? (3-part s...

- Getting heated about heating - energy company ripoffs

- Compensation culture

- Banking on Payment Protection Insurance

- Self-assessment deadline looms

- Public spending cuts - how the poor subsidise the ...

- Banking is a muggers game (4 of 4)

- Banking is a muggers game (3 of 4)

- Banking is a muggers game (2 of 4)

- Take care of excessive banking profits, and the ex...

- Banking is a muggers game (series)

- VAT's the way to do it (3 of 3)

- VAT evasion as a non-violent protest (2 of 3)

- Who pays for the "top talent"?

- Paying in cash is VAT avoidance by any other name ...

- Cuckoos In The Nest Egg - As we approach Banking B...

-

▼

January

(16)

© 2010-2017, Hari and Jake. All rights reserved. Powered by Blogger.