There is one thing that all major parties are, and have always been, in unanimous agreement on. Fixing the never-ending housing crisis.

The benefits would cascade into other big vote winners. Take these three. Sensible house prices leave more money in everyone's pockets to boost the rest of the economy. Being low paid will hurt less. And a major house building programme away from London and the south east would underpin a big-picture coordinated regeneration of the regions.

So why hasn't the problem been swept away to the deafening cheers and applause of all sides of the house? Because of the political and "economic" reasons for never doing so. Let's walk this one through.

Why are those rents and house prices so

high?

This is being

fixed, right? Wrong!

Of all the problems we face, surely this is the one that

will be fixed first and fastest. Why? Because the TV news is full of

politicians promising to solve the housing crisis with the same solution: build

more homes. Politicians, of every party, in every election, with no exceptions.

So, that’s a good start. After all, the UK has some of the

highest rents and house prices in the world.

The average renter in England is spending 43% of their

household income on rent. Most economists will tell you that a maximum of a third of income, a much lower

figure, is what is reasonable.

As for buying a house, latest figures show the average household today takes 24 years to save for a deposit to buy a house.

Back in the 1990s it was only 3 years.

We shouldn’t even be calling it a “housing crisis”, because

the word “crisis” gives the impression that this is an unexpected and temporary

problem. It’s the wrong word to use. It’s clear this has been going on for

decades.

Yet despite all the promises to fix it, the problem just

isn’t going away.

Why are high house

prices and rents a problem?

It’s not, for

some. That’s why it’s not being fixed

If a problem doesn’t go away, you can be pretty sure that

someone doesn’t think it’s a problem at all!

It’s a well known joke among the property-owning classes

that most dinner parties end up with everyone discussing their property prices.

Correction: their rising property prices. And these aren’t super-rich property

moghuls. These are mostly ordinary folk. In the UK around two-thirds of us are

home owners. Most will be over 40, who bought when properties were more

affordable. Some will have got financial help from well-off parents. Either

way, it means they’ll have got on the property ladder without needing

binoculars to see the bottom rung, and a rope and grappling hook to get on it

[cartoon?]. Then there are the millions of landlords. Obviously, they like

rents that comfortably cover the loan (mortgage) used to buy the property in

the first place. The rents keep rising, but the cost of that loan doesn’t. So

it’s a no-brainer to them.

That makes a lot of people who, when they vote, vote for

parties that mouth off about fixing the problem but can be relied upon never to

do so.

And let’s not forget that almost a third of MPs are

landlords, letting out houses or flats.

And let’s not forget that almost a third of MPs are

landlords, letting out houses or flats.

But it is an awful state of affairs for tenants and people

trying to buy. And there are a lot of them too. So it’s tenants versus house

owners and landlords. What can break this deadlock? How about a closer look at

how it’s a huge problem for the economy as a whole. Oh, and simple fairness.

Money should be spent on things that “add value.” In other

words, the customer is getting something new, something more, or fixing

something broken. If you spend more on furniture, you get more or better

furniture. But rapidly rising rents and house prices are delivering the same

old houses. That’s just bad economics.

An efficient economy rewards effort and risk. But landlords

and house-owners are making money with little effort or risk. Very inefficient,

as well as unfair!

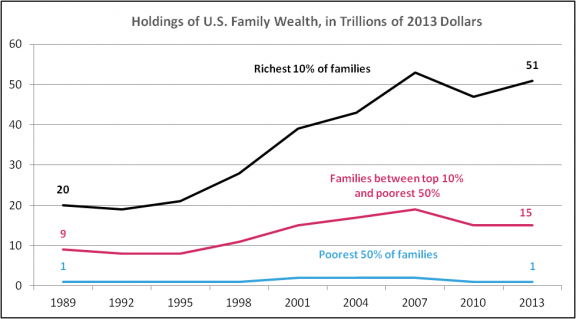

And this all causes deeper problems for the UK economy, to do with spending and saving. Every nation needs its citizens to both spend (to live today) and save (to spend in old age). The spending keeps the economy ticking today. The savings don’t just sit there, but get invested in infrastructure and innovation for the future. Both are essential. Get the balance wrong, and one or other takes a dive and we’re all in deep trouble. Normally, younger people spend much more than they save. Older people, earning more, do most of the saving. That’s normally. But rising house prices have got older people into a bad habit. Why save for your old age when you can, when the time comes, sell your over-priced house? It’s one reason why since the early 1990s Brits have steadily been saving less. In effect, this generation of home owners are getting the young to do their saving for them, by getting them to save up to buy their overpriced house some time in the future.

Which means the next generation are forced to pull the same

trick on those following behind them. And on and on. So here’s a warning to

young people: when your indulgent parent tells you “Darling,

my money is your money,” they’re not kidding.

Which means the next generation are forced to pull the same

trick on those following behind them. And on and on. So here’s a warning to

young people: when your indulgent parent tells you “Darling,

my money is your money,” they’re not kidding.

So that’s the nation’s savings screwed up. What about

spending? Money spent on over-priced rents and houses is money not spent on the

high street. So it’s bad for business and job creation. Yes, landlords spend

too. But 60% of all properties in the private rented sector are owned by

landlords that rent out more than one property.

Half of them, around 30%, are owned by landlords that own 10 or more dwellings.

This changes the pattern of the nation’s spending – how much, and crucially on

which high street - when all those tenants cut their spending to hand over

higher and higher rents to their landlord. Three tenants need three haircuts.

One landlord just needs the one. And what if he’s bald?! We shouldn’t joke, or

some housing minister will promise subsidised hair transplants to bald

landlords, in another pathetic attempt to put another sticking plaster on the disastrous

side-effects of the housing crisis. Yes, landlords will spend their profits on

other things too, but not on your high street. Yes, older home owners will

ultimately sell up and spend some of it. But the same applies. The tenant’s

pound – which should have been spent on their high street – goes to the

landlord. The landlord spends some of it – on his or her high street, wherever

that is! – and likely uses the rest to bid on another house, pushing property

prices up further.

Every government

makes a promise to build enough new homes

Then promptly breaks it

Then promptly breaks it

In 2015 the housing minister said the government aimed to

see one million new homes in England over this Parliament (2015-2020). That’s

200,000 a year. He was one of a long list of ministers over the decades who has

made such promises. By November 2016 the (new) housing minister admitted the target would be missed.

200,000 a year? The last time England hit that figure was

1980. Since then it’s typically been 150,000 or below.

[Graph from the National Audit Office]

But that 200,000 won’t be enough. The National Housing

Federation (NHF) said even more - about 245,000 new homes - are needed each

year in England to stabilise prices.

Nothing near that number is being built. The NHF’s figures

showed only 457,490 were built between 2011 and 2014. The NHF estimate 974,000

homes were needed during that period.

So, at the current rate, we’re not even half way there. That

failure guarantees continued crazy rent and house price inflation, with no end

in sight.

To make matters worse, London has got itself a reputation

throughout the world for being a place where property prices only ever rise. So

even rich overseas investors are buying properties, pushing prices up further.

There are other problems. They make things worse, and need

to be fixed. But they should not be allowed to take attention away from the big

problem: not enough houses. One example is empty houses and empty rooms. In

many cases, some of the richest landlords don’t even bother to rent out their

properties, and leave them empty, so sure they are that their “investment” will

make plenty from prices that keep on rising. Angry politicians have upped the

taxes on empty properties, and rightly so. But only around 200,000 properties

across the whole of the England are ever empty for more than six months,

so a tax on them is just another sticking plaster over a minor wound, while the

major surgery needed is postponed again.

Next. Seven in 10, or 16 million, households in England and

Wales have at least one spare bedroom, with eight million homes having two or

more.

It’s partly down to older parents, whose kids have left, staying in their family

houses rather than downsizing and putting the profit in a pension. That’s what

happens when rapidly rising property prices are a better investment than a

pension. It’s also partly down to people just wanting a spare room. Talking some

of these people (by the way, there’s little talking involved. It’s either

through a benefit cut threat or a tax break bribe) into swapping a large home

for a smaller one, or renting out the spare room, will help but it’s not likely

to significantly change the total number of homes available.

What’s stopping house

building?

The “green

belts”? Or the divisive, corrupt, stupid, and cowardly

People want houses where their jobs are. That means cities

and towns. But building more homes often means building on “green belts”. These

are, as the name suggests, fields, parks and forests that the locals already

enjoy for recreation. The locals don’t want buildings there. Better to build on

“brownfield” sites. This is land that has previously been used for industrial

and commercial purposes and is now derelict. And doesn’t have people in wellies

and flowers in their hair chained to the trees and shouting “go build your

faceless grey concrete monstrosity someplace else”. But even here planning

regulations slow the process down. And even when there is some land available somewhere

in the cities and towns, it is never enough.

What of the land that’s got the planning permission? The

‘big developers’ have ‘a stranglehold on supply’, said Sajid Javid,

the Communities Secretary, and are ‘sitting on land banks’, while ‘delaying

build-out’. Basically, big developers like a housing shortage, because they can

sell their houses for more. Since 2008, the average time lag between a housing

unit being granted permission and the home appearing on the market has risen from 21 to 32 months.

They get away with it because there’s no real competition. The three biggest

players build more than a quarter of all new homes. The top eight account for

half. A House of Lords report said the industry “has all the characteristics ofan oligopoly”.

But there are other reasons that have nothing to do with

space or profiteering big developers, and everything to do with politics.

Property owners don’t want their house prices to fall, which

is what would happen if there were easily enough homes for everyone.

Politicians fear property owners will not vote for them if they put an end to

rapidly rising house prices. Remember, two in three households are property

owners.

Property owners don’t want their house prices to fall, which

is what would happen if there were easily enough homes for everyone.

Politicians fear property owners will not vote for them if they put an end to

rapidly rising house prices. Remember, two in three households are property

owners.

Governments have become addicted to the mirage effect our

dysfunctional housing market has on the nation’s balance sheet. They can sit

back, do nothing, and pass rising house prices off as wealth-creation. Look at

it this way. Let’s say house prices stabilised, and people therefore get to

spend more and more on furniture. The total value of the nation’s furniture

doesn’t get measured! And furniture falls to pieces after a good few years. But

house prices get measured. Now, you’d think that cheaper homes, but hundreds of

thousands more of them (that’s what’s stabilised the house prices), would

result in the same total amount of national housing asset wealth. You’d be

right. But the foolish status quo allows our cowardly governments to steer

clear of fights with those existing property owning voters. But it’s plain

stupid to forego real wealth creation (stable house prices yet many more houses,

leaving households with more money to spend on other things) for fake wealth creation

(same old houses, just more expensive).

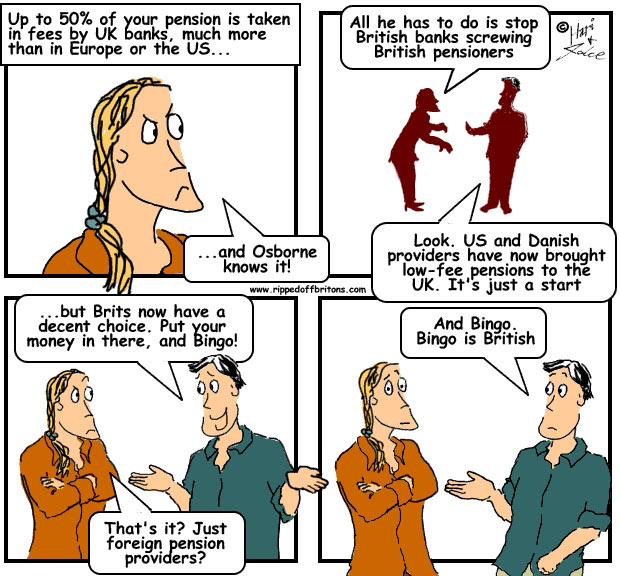

Stabilising house prices stops you using your house as your

pension. You’d have to start using your pension as your pension! Now that’s

crazy talk! Because it would need our pensions system to be fixed. Every decade

has scandals over company pension pots disappearing, banks charging exorbitant

fees for managing your pension, or governments changing the law so that your

pension pays out less than what you expected. Hands up which government has seriously

confronted the companies, banks and their own selves over our crummy pensions?

None. Our governments clearly have little faith in pensions, so no wonder

ordinary people don’t either. So no wonder so many are relying on cashing in

their houses, instead of having a decent pension.

Stabilising house prices stops you using your house as your

pension. You’d have to start using your pension as your pension! Now that’s

crazy talk! Because it would need our pensions system to be fixed. Every decade

has scandals over company pension pots disappearing, banks charging exorbitant

fees for managing your pension, or governments changing the law so that your

pension pays out less than what you expected. Hands up which government has seriously

confronted the companies, banks and their own selves over our crummy pensions?

None. Our governments clearly have little faith in pensions, so no wonder

ordinary people don’t either. So no wonder so many are relying on cashing in

their houses, instead of having a decent pension.

In the 1950s, 60s and 70s, we built new houses like crazy,

averaging over 300,000 a year for twenty years. After that we built the bare

minimum. So it’s divisive, corrupt, stupid, and cowardly. And unfair. It can’t

be fair that young adults have to work so much harder than older generations to

have the same housing.

Prices in London and

the south east are crazy. Why not live somewhere else, somewhere cheaper?

You can’t live

where the jobs aren’t

You need to live near where your job is. There are always cheaper

houses and rents somewhere, but not where jobs are being created. The midlands

and the north are parts of the country that used to thrive – the engine room of

the empire! But since the 1950s most job creation has happened overwhelmingly

in London and the south east, whilst many big industries of the north

(manufacturing, in particular) have shrunk.

We should be less focused on building new homes in London,

and invest and create jobs outside the south-east of England.

For a start, the rest of the UK has the space for the new

houses. The worst of the “green belt” problem goes away – the only good reason

for not building a house.

For a start, the rest of the UK has the space for the new

houses. The worst of the “green belt” problem goes away – the only good reason

for not building a house.

There are other massive benefits. High housing costs in

London and the south east make all the other costs of doing business high. Not

just business rents. Staff need higher pay to cover their own housing costs,

and those rising wages make everything else – cups of coffee, doctors and

nurses, transport, everything – more expensive.

House building outside London is easier and cheaper than in

London. Think of all the pipes and cables you need to lay, running to new

utility plants. Then there are the new schools, hospitals, and other essential

services.

The bigger problem is the creation of the jobs. In

Manchester, Liverpool, Leeds, Newcastle etc. We’d need to get public and

private services and businesses to move to where they had no plans to go. And

their staff.

It can be done. Even that stick-in-the-mud the BBC relocated

1,800 jobs away from London to Salford, near Manchester, and backed the

creation of MediaCityUK.

Many BBC staff were dismayed. Some resigned rather than move. But by 2015 the

BBC employed 2,500 there, with other media organisations employing thousands

more.

Creating jobs outside the south east would be a big vote

winner. The rest of the UK would be delighted by any government that created

jobs in their region, rather than in the usual place: London. All it needs is

for the number of these voters to exceed the number who want property prices to

keep rising. And a strong, visionary and eloquent national leader who can

explain that the current system is unjust, punishes hard working people who

have to rent and can’t get on the property ladder, prone to cartel behaviour by

the builders, and fools the whole economy into creating fake wealth instead of

the real thing.

[SOURCE GUARDIAN: London gets 24 times as much spent on infrastructure per resident than north-east England]

[SOURCE GUARDIAN: London gets 24 times as much spent on infrastructure per resident than north-east England]