TOP STORIES

-

LATEST: Only London and the South East have recovered from the bank crash, says Bank of England director

Nor has the "jobs recovery" been a "wages recovery." Well done Cameron and Osborne -

DON'T BE FOOLED: BREXIT was about Inequality not Immigration. Why won't politicians, pundits and social media realise this?

Because blaming racists, or "unpatriotic" internationalists, is so much easier than blaming yourselves -

RIP-OFF NEWS ROUND-UP, OUR PICK OF THE LAST MONTH'S MEDIA

Paradise Papers: Queen and Bono kept money in offshore funds, leaked files reveal

Cameron's former energy minister lands top job at Russian oligarch's metals firm

UK mobile phone firms overcharging customers after contracts expire, +more stories...

-

ELECTION 2020: Since 1997 the percentage of those under 55 who don't vote has doubled

Who Dares (to win them back) Wins -

EYE OPENER: The Top 1% are paying more income tax? Because their income has doubled since 1995 while the bottom 90%'s has stagnated

Half of us are borrowing to cover living costs. Since the 1980s the poorest fifth have been borrowing more and more

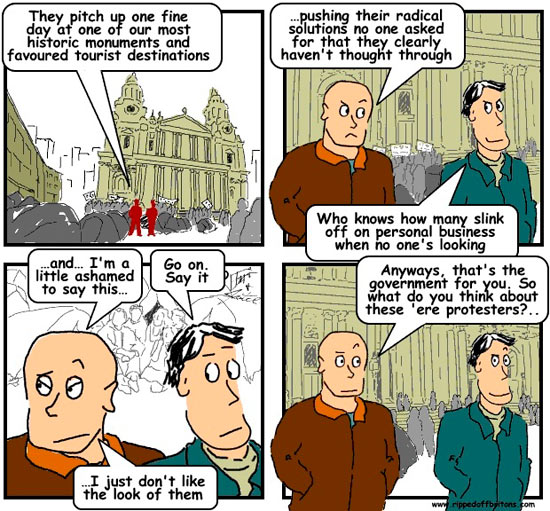

CARTOONS

Monday, 28 November 2011

Sunday, 27 November 2011

Sunday, November 27, 2011

Posted by Jake

2 comments

Labels: Article, banks, Bonus, credit crunch, inequality, pay, taxation

Euro debt is being passed around like a ticking bomb wrapped in gilt edged paper. In this explosive game of pass-the-parcel, governments and banks are colluding in leaving the prize in the hands of ordinary ripped-off Europeans, including us Britons.

Greece, Spain, and even Germany are having trouble borrowing money. But, to be clear, they are not borrowing money to pay their running costs – keeping public services going – but to pay off their bankers.

Governments borrow billions. To try and keep the costs down, they borrow money for different lengths of time, typically between 3 months and 30 years, so they can negotiate better terms with different types of investors. This means they have to continually re-finance their debt. As one loan becomes due, they borrow another chunk of money to pay it off. The Economist newspaper shows the gory details: figures for France, Italy and Spain show they need to borrow fresh € billions each week not to fund fresh spending but just to pay back their existing loans.

Governments borrow billions. To try and keep the costs down, they borrow money for different lengths of time, typically between 3 months and 30 years, so they can negotiate better terms with different types of investors. This means they have to continually re-finance their debt. As one loan becomes due, they borrow another chunk of money to pay it off. The Economist newspaper shows the gory details: figures for France, Italy and Spain show they need to borrow fresh € billions each week not to fund fresh spending but just to pay back their existing loans.

The Greek government has for some time been in a position where it can't pay. Money isn't there, it isn't approaching, it isn't anywhere in sight, not a sniff of it. This is when the bankers get worried. It is no different to the sub-prime mortgage crisis, except the banks can't foreclose on Greece. Nor on Spain, Italy, and certain other embarrassing states.

When a state says it can't pay, it is because new lenders aren't willing to loan money to pay off old lenders. Bankers are now left with two options:

a) Write off the loan, and take a whacking loss

b) Find a sucker on whom the loan can be palmed off (guess who)

Wednesday, 23 November 2011

Wednesday, November 23, 2011

Posted by Hari

No comments

Labels: elections, Labour, LibDems, MP, politicians, the government, Tories

Saturday, 19 November 2011

Saturday, November 19, 2011

Posted by Jake

No comments

Labels: Article, Big Society, credit crunch, inequality, pay, pensions, taxation

The debate on reducing the deficit circles stubbornly around two options:

Option1: Cutting spending

Option2: Continuing spending with borrowed money

Neither the previous Labour nor the current Conservative led government wanted to waste a good crisis: both eagerly took the opportunity to reduce the circumstances of us ripped-off Britons by cutting salaries, pensions, benefits, and laying people off. Proposals have been made to water down the minimum wage and allow employers to dismiss staff without a reason. Borrow more, or cut benefits and sack the less well off. The repeated lie that "we are all in this together". Both political parties chose to ignore the third option staring us in the face. The third way may not be a pretty option, but in this crisis none of them are. The third way, whisper it softly, a well targeted tax aimed at the best kept open secret tax haven.

Neither the previous Labour nor the current Conservative led government wanted to waste a good crisis: both eagerly took the opportunity to reduce the circumstances of us ripped-off Britons by cutting salaries, pensions, benefits, and laying people off. Proposals have been made to water down the minimum wage and allow employers to dismiss staff without a reason. Borrow more, or cut benefits and sack the less well off. The repeated lie that "we are all in this together". Both political parties chose to ignore the third option staring us in the face. The third way may not be a pretty option, but in this crisis none of them are. The third way, whisper it softly, a well targeted tax aimed at the best kept open secret tax haven.

Tax avoidance has taken many of its tactics from the natural world, including running and hiding, with the British government licensing many of the hidey-holes in Britain and in British overseas territories around the world for anyone who can afford the fees.

Another effective method used by plants and animals is disguise. By disguising themselves as another dangerous creature, harmless tasty bite-size morsels can successfully avoid their predators. As an example, the otherwise succulent spicebush swallowtail caterpillar scares off predators by mimicking a snake. (Picture from wikimedia by Michael Hodge). Financial services are masters at this tactic, claiming to tax or regulate them more would make the whole economy feel distinctly unwell and fall over. Government ministers of all shades, perhaps looking forward to topping up their retirement incomes with the occasional £25k fee making speeches at professional dinners, find this argument highly compelling.

Intriguingly, however, it is the opposite tactic not much used in nature that has proved the single most successful tax avoidance ruse in the UK. Little beasts sitting in plain site with a “Here I am! Defenceless and Delicious!” sign was presumably a ruse extinguished early on in the evolutionary race. The practitioners were rapidly snapped up and digested. And yet, as a tax avoidance tactic it has been a thundering success. Highly visible displays of wealth - property, jewellery and other valuables - elicit not a nibble from the hungry taxman. A tactic like this can only work for those creatures who sit at the top of the food chain.

The wealth that comes to us in the form of salaries, interest on bank savings, and the few other sources of income most people have are quickly and pitilessly taxed.

In the UK, the predatory taxmen have been instructed by their political handlers from successive governments not to take a bite out of another source of our more privileged brethren’s growing wealth: “Unrealised capital gains”.

Unrealised capital gains mount up in a chap’s possessions. The capital gain is the difference between what was originally paid for it, and its current value. It comes in the changing value of the property and share portfolios, the collections of furniture, art, jewellery and other such movable and immovable property, and a well funded pension.

Wednesday, 16 November 2011

Wednesday, November 16, 2011

Posted by Hari

No comments

Labels: Bank of England, Inflation, Osborne, retailers

Sunday, 13 November 2011

Sunday, November 13, 2011

Posted by Jake

No comments

Labels: Article, banks, Cameron, education, FSA, politicians, regulation

The government’s initial response to the petition to make financial education in schools compulsory is that it isn’t really necessary. All that is needed, claims the government, is to encourage parents to teach their kids, and to tweak an existing non-compulsory “Personal, Social, Health, and Economic” school course about which I will come back to below.

Martin Lewis, of moneysavingexpert.com, who started this petition has said "The petition is about compulsory financial education. PSHE, which it mentions, isn't compulsory, nor is personal finance a substantial part of this.”

Once again, our rulers see their prime responsibility as helping the companies help themselves. Successive governments have ensured weak laws, puny regulators, and now they would withhold education from children. After all, consumer law puts the responsibility of being "reasonably well informed" on the consumer. Keeping customers ignorant is a loophole in consumer law that bankers riding camels can canter through.

Times have changed so little, with the mass of the population regarded by our supposed guardians as lawful prey. Presumably they see themselves not as shepherds, but as game-keepers.

The British ruling classes once had a simple formula when it came to their children. Knowing they needed a male heir and a couple of spares (in case of accidents) to ensure the inherited lands and chattels stayed in the family, they bred at least a brace and a half of sons. To keep the boys gainfully employed they plotted their career paths thus:

- The oldest inherited

- The second joined the army

- The third became a priest

Not only did this keep the purse strings in family hands, it also kept those strings tied firmly as a garrotte around the neck of the nation. In churches around the country congregations once enthusiastically sang:

All creatures great and small,

All things wise and wonderful,

The Lord God made them all.

The rich man in his castle,

The poor man at his gate,

God made them high and lowly,

And ordered their estate.

To keep the poor at the first son’s gate, the third son would tell the population that god willed it so, and the second son threatened to thump them if they dared touch the railings.

Times change. Inheritance no longer goes automatically to the oldest male – not even the British crown. The priesthood and the army are no longer careers of choice among the wealthy. And that “rich man in his castle” verse has disappeared from the hymn in many modern hymnals.

However, “plus ça change, plus c’est la même chose”, the more things change the more they stay the same. From the way we Britons continue to be ripped off, it seems that the new mercantile gentry now dispose of their children thus:

- The oldest becomes a banker

- The second a regulator

- The third a judge

- The illegitimates become MPs

Land is not the cash-cow it once was - the cash-cow is now us ripped-off Britons. How else can we explain the series of ‘great escapes’ the financial services industry has pulled off? All passed with a cheery wave by the regulators and the courts: excessive overdraft charges; pillaging with-profits fund assets; excessive pension charges; the rip-off of teaser rates. Scams costing ripped-off Britons literally £billions that regulators, judges, and parliament have decreed to be just fine.

They claim that “Parents can also play a crucial role in helping young people to become financially aware..” Really? Repeated corporate shenanigans have shown that companies from banks to telecoms to energy to supermarkets find bamboozling their adult customers a very easy challenge. One reason parents are so easily ripped off is because there was no compulsory financial education during their school days.

So let’s take a closer look at the government’s other assertion that improving the quality of “Personal, Social, Health and Economic (PSHE) education” will prepare the children for the world of finance. We assume, being the optimists we are, that the government’s idea of preparation doesn’t involve laying the sucklings on a silver tray with an apple in their mouths and sprigs of parsley between their toes. So what is PSHE is all about?

Friday, 11 November 2011

Friday, November 11, 2011

Posted by Hari

No comments

Labels: budget cuts, credit crunch, energy, inequality, Inflation, jobs, OFGEM, politicians, protests

Wednesday, 9 November 2011

Wednesday, November 09, 2011

Posted by Hari

No comments

Labels: regulation, retailers, supermarkets, the government

Sunday, 6 November 2011

Sunday, November 06, 2011

Posted by Jake

3 comments

Labels: Article, Bank of England, banks, Bonus, credit crunch, FSA, inequality, OFT, pay

So the Church lifted its threat to send in large padded men to throw the campers out, and the protest outside St. Paul’s Cathedral in London continued. In a conversion on the road to the High Court worthy of St. Paul himself, the clergy suddenly realised “what Jesus would do” if he were physically, as well as spiritually, in the Cathedral. Jesus would be applying the toe of his physical sandal to their highly embroidered clerical backsides. Who were the greater malefactors when Jesus threw the money lenders out of the temple in Jerusalem? The moneymen, who were suckering customers with every rip-off man’s laws and the regulators permitted? Or the priests who succoured the moneymen?

This blog has repeatedly stated: deal with the excessive profits and the bonuses will deal with themselves. For Ripped-Off Britons to be less ripped off, the amount of the bankers’ bonus in itself is irrelevant. It is the rip-offs that pay for the bonuses that are the problem.

Blocking bankers' bonuses can easily be dismissed as being envy driven. On the other hand, reducing rip-off profits is just good sense. Bankers will argue that their profits aren’t rip-offs, but are the fruits of their being extremely clever and courageous. The hilarious speech by Bob Diamond, the boss of Barclays Bank, on the BBC is a good example of what they want us to believe. Having said in January 2011 that the “period for remorse and apology” was over, his latest position is “we have to accept responsibility for what has gone wrong". “We know it's not enough just to apologise” says uncle Bob.

Diamond pointed out that banks provide an important service, including putting together a pool of investors who can lend money to, among others, governments to service their debt. He said that government debt as a proportion of GDP is

He didn’t need to look back 10 years, 3 years would have been enough as the debt more than tripled in 2008 at one of the heights of the banking crisis, because governments borrowed money to bail out the banks. And the banks now make handsome profits lending money to governments to cover the loans taken by governments to bail out the banks.

- When I was in Yorkshire earlier this year, I met R&R Ice Cream. R&R Ice Cream started as a small family business...

- I also met with Swann Morton in Sheffield, the home of steel manufacturing. They began in the 1930s making razor blades for the UK.

- Sukhpal Singh is an entrepreneur I met in Cambridge who came here as a refugee from Uganda in the 1970s. At the age of 18 he borrowed £5,000 - from his father and from a local bank - to buy a car parts shop in North London.

In the post-speech interview with BBC Radio4’s John Humphrys, Diamond said that Bankers can be cuddly. So lets take a closer look at how cuddly they are, in an area where just about every one of us is affected – our bank accounts.

With Which?, the organisation championing consumers, and the ironically named Financial Services Authority (FSA), whose purpose has never been clear, highlighting potential problems with Packaged Current Accounts, we shall look more generally at personal bank accounts which earn the banks £billions in charges. (The FSA’s hyperactivity in the final months before its abolition is akin to a drunken uncle who having disgraced himself at dinner insists on doing the washing up to try and leave behind a more positive memory.) We shall see whether the £billions of profits are the rewards of being extremely clever and cuddly, or just the proceeds of thuggish muggings.

Follow Us

Search Us

Trending

Labels

advertising

Article

Austerity

Bank of England

banks

benefits

Big Society

BIJ

Bonus

Brexit

British Bankers Assoc

budget cuts

Cameron

CBI

Clegg

Comment

credit crunch

defence

education

elections

energy

environment

executive

expense fraud

FCA

FFS

FSA

Gove

Graphs

Guest

HMRC

housing

immigration

inequality

Inflation

insurance

jobs

Labour

leisure

LibDems

Liebrary

Manufacturing

media

Miliband

MP

NHS

OFCOM

Offshore

OFGEM

OFT

Osborne

outsourcing

pay

pensions

pharma

police

politicians

Poll

property

protests

public sector

Puppets

regulation

retailers

Roundup

sales techniques

series

SFO

Shares

sports

supermarkets

taxation

Telecoms

the courts

the government

tobacco

Tories

transport

TUC

UK Uncut

unions

Vince

water

Archive

-

▼

2011

(178)

-

▼

November

(12)

- Low-cost accommodation property scandal

- After sub-prime mortgages, how ripped-off European...

- Party funding the impartial way

- Paying off the deficit - is there another option t...

- Fashion victims of the fashion industry

- Economic and weather forecasts collide

- Compulsory Financial Education in schools – the go...

- Get into the philanthropic spirit to take you mind...

- Food waste and the seven deadly sins

- Personal bank accounts cost us £billions, the surp...

- Getting ahead in the jobs market

- Danish pension plan is no fairytale

-

▼

November

(12)

© 2010-2017, Hari and Jake. All rights reserved. Powered by Blogger.