Posted by Jake on Saturday, June 23, 2012 with 8 comments | Labels: Article, banks, budget cuts, inequality, Liebrary

If you repeat a lie often enough, people will believe it to be true. If there was a GCSE, or O'Level, in Propaganda this would be in Chapter 1.

If you repeat a lie often enough, people will believe it to be true. If there was a GCSE, or O'Level, in Propaganda this would be in Chapter 1.Particularly since the banks crashed the World economy, we have been told by bankers and politicians alike that in spite of the financial sector's misdeeds we should leave it with light regulation, allow its executives to extract excessive salaries, and pump in billions of pounds taken from the rest of the economy to rescue it.

We are told that the job cuts, pay freezes, reduced pensions, cuts to the armed forces, the police, health and education are all sacrifices well worth making in order to save the banks.

Why should we be so generous? We are told that the Financial Services Sector is the greatest engine of growth in employment and wealth in the United Kingdom.

Is this actually true?

Figures presented in a report on banking reform by the University of Manchester's Centre for Research on Socio-Cultural Change (CRESC), titled "An alternative report on UK banking reform", suggest that this is a lie worthy of a place in our Liebrary.

a) Has the financial services industry actually made a huge contribution to the national coffers?

The CRESC report shows that in the five years before the crash in 2008 the financial services industry contributed £208 billion in taxes (including taxes paid by its staff). However the bailout cost was £289 billion, (i.e. over £80 billion more, up to when the CRESC report was written in 2009).

Actually, figures from 1991 to 2007 show that financial sector employment in the UK has been stagnant at around 1 million staff. The collapse in manufacturing jobs in recent decades was taken up by other areas of the services sector, including business services, education and health; all sectors that are now being punished for the misdeeds of the Financial Sector.

c) Is the Financial Services industry a source of nationwide prosperity?

A separate paper by CRESC shows that 44% of financial services jobs are in London and the South East, while in other parts of the UK it is only a minor employer. It is these other parts of the UK that are bearing the brunt of the economic and social pain caused by the banking bust. As the Governor of the Bank of England said, "The price of this financial crisis is being paid by those who absolutely did not cause it".

So Financial Services are just another part of the economy. Not especially important nor especially unimportant. And yet successive British governments have gone extravagantly and ruinously out of their way to protect the Financial Services Industry:

- Allow their executives to evade personal sanctions for their misdeeds, by not having to admit wrongdoing.

- Impose any fines for bank wrongdoing that are a tiny percentage of their profits, making fines less a punishment and more a cost of doing business as usual.

- Use those fines to subsidise the self same financial services industry.

- Enable banks to avoid tax, with corporation tax from this so called 'engine' contributing just 2% of UK tax revenues.

- Allow banks to charge excessive pension fees that are among the prime reasons for the pension crisis and pensioner poverty.

- Do not force the banks to ensure customers are aware when interest rates and the like are cut. They are free to bury the bad news in the obscurity of the small print.

- Allow the industry to run a multi-billion tax avoidance industry, robbing governments around the world, including the British government, of their due taxes.

- Give the banking industry cheap loans, which they lend back to governments at higher rates who need to borrow money to bail out the selfsame banks.

- Avoid educating the nation's children, so they continue to fall prey to the scams the financial industry will try and trick them with.

And the irony is, to the Financial sector the 1st comment to this article, which is obviously from a Spambot, would be a legitimate response ie jargon and random words used to imply competency in a made up world.

ReplyDeleteWell said! I've deleted the spam bot so their link is removed. but here's what it said: A good financial services provider giving always a good advise for any business because he search all the things which would be need for any financial based business. Financial services communication expertise for financial services. Yes, ideas are conceived, is leading financial services communication firm. We're expert at what we do. Like social media, PR, content marketing & communication consulting. Like all of these work should be divided between the advisor. We are told that the Financial Services Sector is the greatest engine of growth in employment and wealth in the United Kingdom.

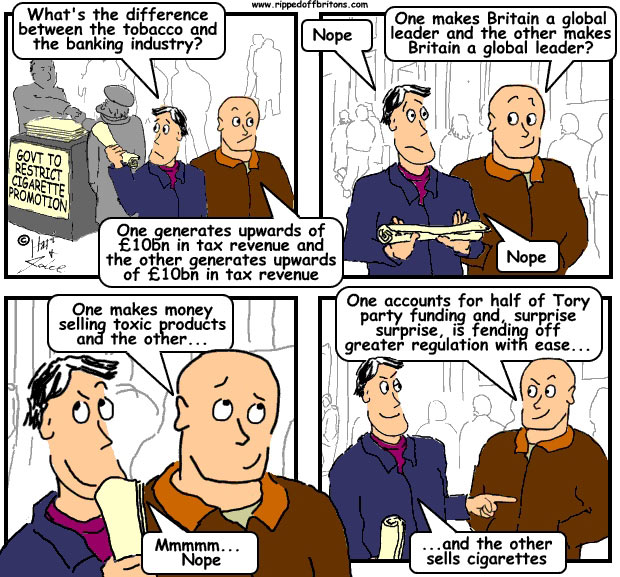

DeleteSums it up nicely. Tory pary contributions come from bankers pockets. Not a good idea to bite the hand that feeds you even if it starves the nation!

ReplyDeleteIt is long past time to remove private and union funding of political parties. It creates a conflict of interest which is not in the interests of the country.

I keep saying lets buy the other 14% of RBS shares and make it our Nationalised Bank? I am greeted with howls of derision saying "we can not have a large bank under the influence of Politicians it's dangerous!" Now am I missing the point or has it not proved more dangerous to have "a large bank of Politicians under the influence of a Bank"??????????

ReplyDeleteNice post

ReplyDeleteThank god for the office of national statistics, wondering when the Gov will make cuts there. Great article, the links to the CRESC papers no longer work. Can you provide the original paper title? Cheers

ReplyDeleteThanks for spotting the broken link. Here is the currently working link:

Deletehttp://www.cresc.ac.uk/sites/default/files/Alternative%20report%20on%20banking%20V2.pdf

The title of the CRESC paper is "An alternative report on UK banking reform" should the link change again in the future.

Time to read The Shock Doctrine by Naomi Klein folks...

ReplyDelete