Mervyn King, Governor of the Bank of England, March 2011.

Post Credit-Crisis austerity has been about taking less from the wealthy, and taking more from everyone else. Income tax cuts for the rich; wage freezes, pensions and benefits cuts for the rest.

|

| Office of National Statistics Living Costs and Food Survey |

Consumption taxes, like VAT, have gone up hitting ordinary Britons harder than the wealthy. Why harder? Because ordinary people spend all they earn to pay their bills, while the rich have surplus income to save. You don't pay consumption tax on what you don't consume. In this post, we reveal data from the Paris School of Economics that show how the 90% had their share of the boom stolen. The same 90% who are now made to endure austerity to pay for the bust.

They reassure us that it is for our sake that energy companies hike prices, for our comfort that pension companies take up to 50% of our savings in fees, and it is to give us free banking that banks charge us extra. Which coincidentally generate the profits to pay the massive bonuses and pay for the elite we should be celebrating. We are told we ordinary Britons would be worse off if these were not so.

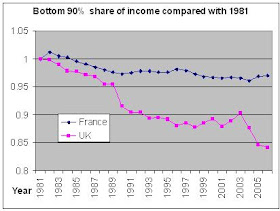

But is this actually true? The lie is exposed by comparing how the income shares of the elites in France and in Britain have changed.

France and Britain have in recent history done about the same in terms of GDP (see graph at bottom of this post). Using Purchasing Power Parity (PPP), which shows the actual buying power of their money, in 2011 British GDP per person was US$36,500 while the French was US$35,200 per person. A difference in sterling of £2.50 a day.

Britain and France: two nations, both alike in dignity as well as GDP. But between 1981 and 2006 British elites sucked up income ten times faster than the French elite. And the lower 90% of Britons saw their share drop five times faster than the equivalent group of Frenchman.

- Top 0.1%: in France share increased by 40%; in Britain share increased by 362%

- Top 1% : in France share increased by 18%; in Britain share increased by 222%

- Bottom 90%: in France share dropped by 3%; in Britain share dropped by 16%

|

| http://g-mond.parisschoolofeconomics.eu/topincomes/ |

No, I don't know why there is a gap in the dataset for the UK between 1986 and 1992

|

| http://g-mond.parisschoolofeconomics.eu/topincomes/ |

|

| http://g-mond.parisschoolofeconomics.eu/topincomes/ |

For clarity,the drop in share has resulted in a stagnation of income of the bottom 90%.

|

| http://g-mond.parisschoolofeconomics.eu/topincomes/ |

So, next time someone tells you that great inequality is good for everyone send them a link to this post.

Dear Colleagues

ReplyDeleteThis is a good piece ... UK has some of the same bad characteristics that also exist in USA.

But inequality is a result and not a cause.

What is the cause, and what might be the best way out of this mess?

I argue that the way resources are allocated in the modern economy is based on a wrong premise, that money profit should be optimized. Rather the value flows should be optimized so that value performance is as good as it can be given the critical parameters of modern society.

Decision makers need to organize knowledge, people, and natural, money and material resources so that quality of life is maximized. For this the measure needs to be more than money profit and money wealth.

TrueValueMetrics and Value Accountancy address the question of value flow performance. These incentives and measures may well be the most effective way to change behavior.

Peter Burgess @truevaluemetric

There are dozens of causes.

DeleteNeoliberal ideas have resulted in thousands of little changes that benefit the richest people, (sometimes self labelled as the 'meritocracy').

My favourite texts for understanding what has happened are Karl Polanyi's 'The Great Transformation' and Naomi Klein's 'Shock Doctrine'

"But inequality is a result and not a cause.

ReplyDeleteWhat is the cause, and what might be the best way out of this mess?"

The cause was Gordon Brown and his changes to the financial systems that allowed perverse incentinves AND moral hazards to run unchecked.

All big things are bad, Monopolies, gangs, families and empires all grow until they implode. Brown allowed this to happen. Under thatcher we had the Mergers and Monopolies commission that prevented exactly this from happening.

If you're going to throw blame about blame these people in this order.

Keynes

Brown

Labour.

http://non-sequitur.co.uk/index.php/136-why-david-harvey-is-wrong-on-capitalism

Are you kidding me!? Thatcher deregulated everything, sure Labour didn't stop it, but FACT is Thatcher opened this can of worms. Shutting down industry, to make the UK solely reliant on dodgy financial services... and after years of not investing and spending money on infrastructure, well Labour had no choice but to spend a lot of money in areas conservatives had neglected.

ReplyDeleteIt all starts with Thatcher, and as a woman it pains me to say so.

Thatcher started it all. Watch the Keiser report/ North sea oil saved Margaret Thatcher.

ReplyDeletePerhaps the 'new' financial demands will have to be PAID by the extremely rich beneficiaries of the Tory 'cuts'?

ReplyDeleteThatcher most certainly instigated the neoliberal policies that got us into this mess of social and economic inequality. She turned polytechnics into universities and destroyed vocational qualifications, which had been good for innovation in the manufacturing and engineering industries. She created a financial economy by deregulating financial services and by encouraging ordinary people to buy shares in the utilities they already owned. The middle class expanded and believed the lie of the trickle down effect of capital creation. When in reality the rich just get richer by hoarding their wealth or sending it offshore to grow in tax free investment funds.

ReplyDelete