Posted by Jake on Sunday, November 06, 2011 with 3 comments | Labels: Article, Bank of England, banks, Bonus, credit crunch, FSA, inequality, OFT, pay

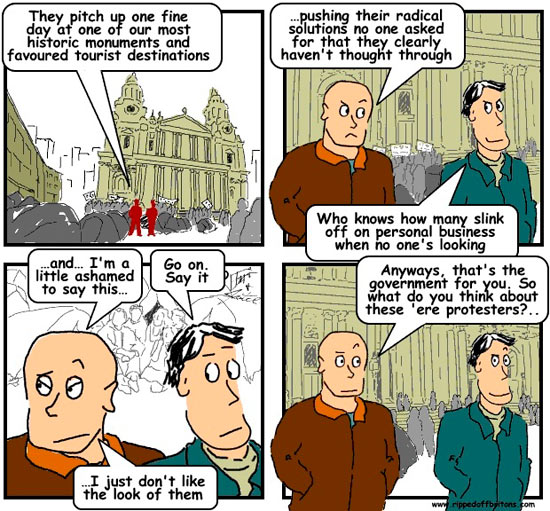

So the Church lifted its threat to send in large padded men to throw the campers out, and the protest outside St. Paul’s Cathedral in London continued. In a conversion on the road to the High Court worthy of St. Paul himself, the clergy suddenly realised “what Jesus would do” if he were physically, as well as spiritually, in the Cathedral. Jesus would be applying the toe of his physical sandal to their highly embroidered clerical backsides. Who were the greater malefactors when Jesus threw the money lenders out of the temple in Jerusalem? The moneymen, who were suckering customers with every rip-off man’s laws and the regulators permitted? Or the priests who succoured the moneymen?

This blog has repeatedly stated: deal with the excessive profits and the bonuses will deal with themselves. For Ripped-Off Britons to be less ripped off, the amount of the bankers’ bonus in itself is irrelevant. It is the rip-offs that pay for the bonuses that are the problem.

Blocking bankers' bonuses can easily be dismissed as being envy driven. On the other hand, reducing rip-off profits is just good sense. Bankers will argue that their profits aren’t rip-offs, but are the fruits of their being extremely clever and courageous. The hilarious speech by Bob Diamond, the boss of Barclays Bank, on the BBC is a good example of what they want us to believe. Having said in January 2011 that the “period for remorse and apology” was over, his latest position is “we have to accept responsibility for what has gone wrong". “We know it's not enough just to apologise” says uncle Bob.

Diamond pointed out that banks provide an important service, including putting together a pool of investors who can lend money to, among others, governments to service their debt. He said that government debt as a proportion of GDP is

He didn’t need to look back 10 years, 3 years would have been enough as the debt more than tripled in 2008 at one of the heights of the banking crisis, because governments borrowed money to bail out the banks. And the banks now make handsome profits lending money to governments to cover the loans taken by governments to bail out the banks.

- When I was in Yorkshire earlier this year, I met R&R Ice Cream. R&R Ice Cream started as a small family business...

- I also met with Swann Morton in Sheffield, the home of steel manufacturing. They began in the 1930s making razor blades for the UK.

- Sukhpal Singh is an entrepreneur I met in Cambridge who came here as a refugee from Uganda in the 1970s. At the age of 18 he borrowed £5,000 - from his father and from a local bank - to buy a car parts shop in North London.

In the post-speech interview with BBC Radio4’s John Humphrys, Diamond said that Bankers can be cuddly. So lets take a closer look at how cuddly they are, in an area where just about every one of us is affected – our bank accounts.

With Which?, the organisation championing consumers, and the ironically named Financial Services Authority (FSA), whose purpose has never been clear, highlighting potential problems with Packaged Current Accounts, we shall look more generally at personal bank accounts which earn the banks £billions in charges. (The FSA’s hyperactivity in the final months before its abolition is akin to a drunken uncle who having disgraced himself at dinner insists on doing the washing up to try and leave behind a more positive memory.) We shall see whether the £billions of profits are the rewards of being extremely clever and cuddly, or just the proceeds of thuggish muggings.

Muggers come in various forms. Some with menaces, some with smiles, and some in suits. All have the same objective – to relieve you of your money. Uniquely among muggers, the banks use all three tactics.

The menace of penalties is perhaps the greatest example of the banks preying on the their customers. An Office of Fair Trading report, published in October 2009, stated;

In plain English, the banks maintained a pot of on average £680m for a year to cover unauthorised overdrafts. They charged the borrowers £1.5bn in interest and penalties – a return of 220%. Some of the more hard-up Britons paid the banks 220 percent interest on their unauthorised overdrafts. The report found that it was the same group getting hit repeatedly, with 39% of them getting penalised more than 6 times in a year. Transferring £1.5 billion in a year from the hard-up to the banks.

Smiling at you from advertising in print, internet, and television, various animate and animated characters promise High, Extra, Gold, Reward, Plus, Premier, Advantage, and other hyperbolically named financial products. Chief among these is the humble current account, yielding to the banks in 2006 a £4.1 billion bounty of “net credit interest”. The same October 2009 OFT study stated:

“The two main sources of revenue from PCAs [Personal Current Accounts] are net credit interest and unarranged overdraft charges. Although the perception of banking is that it is free, in 2006 PCA providers' total revenue from PCAs was £8.3 billion, equating to £152 per active PCA. Of this, £4.1 billion came from net credit interest”

|

| http://www.oft.gov.uk/shared_oft/reports/financial_products/OFT1005.pdf |

Net Credit Interest is money made from the difference between what the banks charge a customer to borrow money, and what they pay a customer to deposit money. The staggering size of this rip-off can be seen from these figures from the Bank of England.

Particularly since the crisis of 2008, the gap between what the banks pay savers and what they charge borrowers has gaped. Savers in ‘instant access’ accounts are effectively being paid nothing.

The Office of Fair Trading’s study on current accounts,published in 2008, illustrates how the Big Four banks (HSBC, Barclays, Lloyds, and RBS) have taken extreme advantage of this differential compared with the smaller and newer banks who are vying for market share.

And it is at the hands of the pinstriped gent, man or woman, that the quiet mugging takes place. To reinforce the illusion of ‘free bank accounts’, the banks created ‘not free bank accounts’ – more commonly known as Packaged Current Accounts. Accounts that are bundled with insurance products, including travel, mobile phone, and car breakdown.

Back in 2006 15% of accounts were fee paying Packaged Accounts, generating £560m in profits for that year. The FSA’s report in 2011 states that this had risen to 20% of all accounts, approximately 10 million accounts. Enough to trigger an enquiry by the FSA into potential mis-selling. The FSA observed:

An investigation by the consumer organisation Which? found:

According to Defaqto, the financial research company, the top three packaged account incentives are:

- Travel insurance

- Car breakdown cover

- Mobile phone insurance

The average cost of these accounts is £15.44 a month

Which exposes a rip-off in itself.

- Average cost per month of £15.44

- £185.28 per year

However, if you looked around a bit (apologies for this uncharacteristic unavoidable, and unremunerated, advertising)

- Free bank account with travel insurance from Nationwide: £0, zip, zero.

- Mobile phone insurance from ‘protectyourbubble’: £17.88 per year

- RAC breakdown cover UK wide: £39

- Total £56.88 per year

Banks have successfully argued in court that it doesn’t matter if their charges are rip-offs, because they are specified in the terms & conditions which are understandable to the ‘average consumer’ – which is how they defeated the OFT in the Supreme Court over rip-off overdraft charges. However, the mendacity of this claim was exposed by the parliamentary Treasury Committee’s enquiry into “Competition and choice in retail banking” in November 2010. In a session with Helen Weir (executive director of Lloyds Banking Group), Adam Phillips (Chairman of the Financial Services Consumer Panel), and Lord Turner (Chairman of the FSA), it was minuted that:

“76. Ms Weir seemed confident that consumers would know the cost to them of operating a current account, telling us that "most consumers would have a pretty good idea of what they are paying for their current [account] banking. However, when we pressed her to say how much she paid in terms of interest foregone herself, she was unable to answer.[90] Ms Weir was not the only witness who was unable to tell us the cost of their current account. Lord Turner explained that he did not know, although unlike Ms Weir he did not argue that most consumers would know.[91] Adam Phillips was similarly unable to tell us how much he was paying for his current account.[92]

Benny Higgins [CEO of Tesco Bank] stated "very few people" would be able to quantify the cost of their current account and concluded that the inability of most consumers to calculate such costs "strikes at the heart of the issues around competition within current accounts."[93]

77. The distinguished list of financial services experts unable to tell us the cost to them of their current account indicates a serious problem. If they cannot estimate the cost of their accounts, we hold little hope that members of the public are able to do so. Greater disclosure of information on cost is a pre-condition to greater competition in this market.”

Pretending to deal with excessive pay by increasing taxes on the bankers, such as the Tobin Tax to which certain clerics (who should really pay more attention to Jesus on the subject of taxes: render unto Caesar that which is Caesar's, don't involve me in tax matters) have given their blessing, just means bankers will increase their charges on us ripped off Britons.

Clerics, regulators, parliamentarians, the media, the protesters, and the rest, should all focus on the rip-offs. Once the rip-offs are dealt with, the obscene profits of the banks will start to get under control, and bonuses that spur bankers to irrational and immoral behaviour will deal with themselves.

Sir David Walker, new chairman of Barclays Bank says he "favours charging for bank accounts. Walker blames recent mis-selling such as PPI and Interest Rate Swaps as "the consequence of not charging for bank accounts".

ReplyDeleteWalker is oblivious to the £billions taken by the banks by holding our money and paying risible interest.

http://www.telegraph.co.uk/finance/newsbysector/banksandfinance/9469221/Sir-David-Walker-I-will-change-Barclays.html

I'm disappointed your article doesn't address the actual mechanism with which bankers can create ethereal credit from customers deposits. Fractional Reserve Banking. Other than that, it's an entertaining and insightful article.

ReplyDeleteOne thing at a time!

Delete