Posted by Jake on Monday, July 06, 2015 with No comments | Labels: Article, Bank of England, banks, Bonus, credit crunch, FCA, FSA, Graphs, regulation

If you crashed your mum's car, you would be on your best behaviour for a while until she forgave and forgot. You would do all the good things, washing up and stuff, to reduce her anger and mistrust. So she would lend you her car again when it gets back from the garage with the repair bill for your mum to pay.

If you crashed your mum's car, you would be on your best behaviour for a while until she forgave and forgot. You would do all the good things, washing up and stuff, to reduce her anger and mistrust. So she would lend you her car again when it gets back from the garage with the repair bill for your mum to pay. So why, having crashed the World Economy and handing the bill to the World's taxpayers, did the banks carry on regardless with scams like PPI, IRSA, Libor, Forex, aiding tax evasion and money laundering?

Didn't they want to assuage their customers' anger and regain their trust?

Actually, data from the Bank of England shows they weren't bothered.

In July 2015 the Bank of England (BofE) published its biannual "Systemic Risks Survey". This report, produced since 2008, looks into what bankers worry most about.

The survey works by:

"quantifying and tracking, on a biannual basis, market participants’ perceptions of such risks. The survey covers aggregate risks to the UK financial system, including the probability of a future high-impact event and confidence in the stability of the UK financial system, as well as specific sources of risk which could either have a particularly large impact or be especially challenging to manage as a firm"

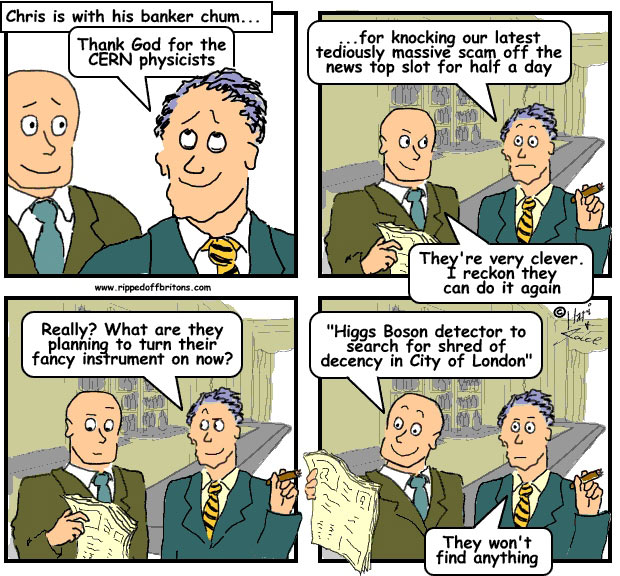

The data reveals since 2008 the Financial Services Industry has never been bothered about public anger and mistrust.

The report identifies 21 specific causes for concern ranging from "Sovereign Risk" to "Cyber Attack". From its first publication "public anger against, or distrust of, financial institutions" ranked lowest or second lowest in twelve of the fourteen reports. Even when banker angst at what their customers thought of them peaked in the first half of 2010 there were only 6 items less important.

On the other hand, the third most scary thing for the finance industry according to the survey is "Risks around regulation/taxes".

In his Mansion House Speech in June 2015 the Chancellor, George Osborne, dropped a heavy hint that the time for regulatory bashing bankers was coming to an end. Osborne said:"simply ratcheting up ever-larger fines that just penalise shareholders, erode capital reserves and diminish the lending potential of the economy is not, in the end, a long term answer."

This is certainly true. However Osborne goes on to say something that probably isn't true:

"individuals who fraudulently manipulate markets and commit financial crime should be treated like the criminals they are – and they will be."

Taking away the £billions of bonuses (the Office for National Statistics states £87 billion paid to UK Financial Services between 2007 and 2013) pocketed during the bank crash and the associated frauds of the last few years has proved impossible. Doubtless some of these bonuses were fairly earned by earnest bank tellers. And doubtless these bank tellers are used as human shields for the 'bad bankers' who won't have to return anything.

Taking away the £billions of bonuses (the Office for National Statistics states £87 billion paid to UK Financial Services between 2007 and 2013) pocketed during the bank crash and the associated frauds of the last few years has proved impossible. Doubtless some of these bonuses were fairly earned by earnest bank tellers. And doubtless these bank tellers are used as human shields for the 'bad bankers' who won't have to return anything.  The Prudential Regulation Authority (PRA, who took over part of the old FSA's job) said in July 2014 the long promised "banker bonus clawback" would come into force for bonuses awarded after January 2015. By June 2015 the PRA for some reason delayed this to January 2016. Giving the bankers an extra year to safely stash their ill-gained swag, and redefine future 'bonuses' as 'allowances' or something else not covered by the clawbacks.

The Prudential Regulation Authority (PRA, who took over part of the old FSA's job) said in July 2014 the long promised "banker bonus clawback" would come into force for bonuses awarded after January 2015. By June 2015 the PRA for some reason delayed this to January 2016. Giving the bankers an extra year to safely stash their ill-gained swag, and redefine future 'bonuses' as 'allowances' or something else not covered by the clawbacks. Christine Lagarde, the head of the IMF, said in May 2014:

"the behavior of the financial sector has not changed fundamentally in a number of dimensions since the crisis. While some changes in behavior are taking place, these are not deep or broad enough. The industry still prizes short-term profit over long-term prudence, today’s bonus over tomorrow’s relationship.

Some prominent firms have even been mired in scandals that violate the most basic ethical norms—LIBOR and foreign exchange rigging, money laundering, illegal foreclosure.

To restore trust, we need a shift toward greater integrity and accountability. We need a stronger and systematic ethical dimension."

Evidence presented to Parliament by IPSOS-Mori shows the depth of public mistrust and support for more regulation in the UK.

To restore trust the bankers need to see trust as something worth restoring, which they evidently don't. To strengthen regulation the government needs to decide who is more important to it, the financial sector or the general public.

Asked which risks would be most challenging to their firms, managing angry customers barely registered at all. Regulation, however, figured highly.

The government is signalling that the frightened little bankers shouldn't worry for their wallets. Osborne will tuck them up and kiss their fears away.

Which of course means the rest of should be afraid, very afraid.

0 comments:

Post a Comment

Note: only a member of this blog may post a comment.