Posted by Hari on Sunday, July 29, 2012 with 2 comments | Labels: Article, banks, Cameron, HMRC, Osborne, taxation

$21 trillion (£13tn) worth of assets are being 'hidden' by a global super-rich to avoid tax. The recent report by the Tax Justice Network, penned by James Henry (a former chief economist at the consultancy McKinsey), got widespread coverage. George Osborne says it’s time to put a stop to it. David Cameron says it’s time we got a slice of that cake (actually, a bigger slice than we already have). We invited Richard Murphy to explain:

By Richard Murphy

Adviser to the Tax Justice Network and the TUC on taxation

and economic issues. He is also the director of Tax Research LLP.

David Cameron seems to want to turn the UK into a haven for

tax avoiders. At least we now know where we stand. In wooing French tax exiles,

Cameron makes a mockery of democracy.

He promised to 'roll out the red carpet' to French

businesses while attending the G20 summit in Mexico, saying in June 2012,

"If the French go ahead with a 75% top rate of tax we will roll out the red carpet and welcome more French businesses to Britain and they will pay taxes in Britain and that will pay for our health service, and our schools and everything else."

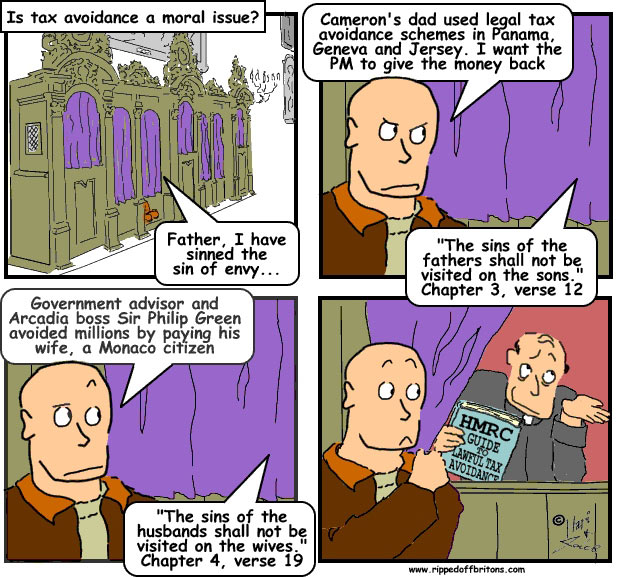

But hang on a minute. His chancellor

said in March, "I regard tax evasion and indeed aggressive tax

avoidance as morally repugnant". What's more, George Osborne

pronounced himself "shocked" at the amount of tax avoidance in the

UK. And yet, here's his boss saying the door's open to all and sundry French

tax avoiders who want to set up camp in the UK.

As for the businesses these tax exiles own, let me assure

Cameron that they will stay put in France, because that's where their markets

are and in the days of the internet the business owner does not have to live

over the shop – something Cameron and Osborne have not yet noticed. So we won't

win there. And that's inevitable – look at the world's tax havens and you'll

see that nothing but the pretence of money shuffling occurs in those places.

As a result Cameron's words are on this occasion, as on so

many others, literally meaningless. In that case it is what Cameron's words

imply that matters. Let me note a few more of them in that case:

"Every country

sets its own tax rates, but I think in a world of global capital, in a world

where we're competing with each other, in a world where we want to send a

message that we want you to build businesses, grow businesses and invest, I

think it's wrong to have completely uncompetitive top rates of tax."

Now that's really interesting, because this is the language

of tax havens. It's places like Jersey, Cayman and the British Virgin islands

who usually talk the language of tax

competition that underpins Cameron's comments.

And, of course, it's tax havens such as Switzerland that

exist to roll out the red carpet for tax exiles. They all do it by offering low

tax rates – something the UK is also capable of doing through its generous tax

residence rules and domicile rules. Perhaps it's no surprise that Philip

Stevens of the Financial Times recently quoted a German official saying that

the UK opting out of a European banking union would turn us into a

"Greater Guernsey". Could it be that with these comments Cameron has

confirmed that "tax haven UK" is the new plan that he and George are

hatching?

Cameron is already trying to pick over the carcass of

France. No doubt he'll do the same for Spain and Italy too, while Greek ship

owners have always had a special place in British tax planning with their abuse of our

domicile rule.

That domicile rule ensures that all those not born in the UK

enjoy favourable tax treatment if they live here. It's an unfair prejudice and

socially divisive. What more could you do to show how dedicated the UK is to

increasing inequality by helping the wealthiest immigrants get richer while the

rest head ever closer to the economic misery of poverty? And we know that house

price inequality caused by wealthy immigrants to the south-east and London makes housing inaccessible to the vast majority in those areas.

That domicile rule ensures that all those not born in the UK

enjoy favourable tax treatment if they live here. It's an unfair prejudice and

socially divisive. What more could you do to show how dedicated the UK is to

increasing inequality by helping the wealthiest immigrants get richer while the

rest head ever closer to the economic misery of poverty? And we know that house

price inequality caused by wealthy immigrants to the south-east and London makes housing inaccessible to the vast majority in those areas.

That's what Cameron seems to want for us, speaking on the same day The Times, which has conducted its own investigation into

tax avoidance, said:

"The British tax system is unfair. It charges the vast

majority of people the basic rate of income tax, and expects them to pay. It

asks a minority to pay higher rates of tax, and then invites them to avoid

it."

That's right. And The Times has demanded that the tax system

be changed. But if Cameron has his way he'll keep all the prejudice, bias, discrimination

and abuse in place, and all for the purpose of undermining our international

allies and EU partners in their efforts to balance their books and restore

economic wellbeing.

Except it's even worse than that. What he's also said is

he'll seek to undermine a decision that the people of France have

democratically chosen. That's what tax havens do – they hold democracy in

contempt. This all bodes ill for equality and for our hopes of diversifying the

UK economy away from a finance industry dedicated to servicing transient wealth

that holds the long-term residents of the UK in contempt.

All we can say in that case is thanks Dave: at least you've

set out your true agenda.

This article first appeared in the Guardian.

Has anybody read Nicholas Shaxson's 'Treasure Islands'? According to him, the BOE is already one of the world's largest tax-havens. Is he wrong?

ReplyDeleteCombine the UK with British Oversease Territories and the Channel Islands we are second to none as a tax haven.

DeleteSee our post here:

http://www.blog.rippedoffbritons.com/2011/05/pirate-enterprise-britains-sponsorship.html