TOP STORIES

-

LATEST: Only London and the South East have recovered from the bank crash, says Bank of England director

Nor has the "jobs recovery" been a "wages recovery." Well done Cameron and Osborne -

DON'T BE FOOLED: BREXIT was about Inequality not Immigration. Why won't politicians, pundits and social media realise this?

Because blaming racists, or "unpatriotic" internationalists, is so much easier than blaming yourselves -

RIP-OFF NEWS ROUND-UP, OUR PICK OF THE LAST MONTH'S MEDIA

Paradise Papers: Queen and Bono kept money in offshore funds, leaked files reveal

Cameron's former energy minister lands top job at Russian oligarch's metals firm

UK mobile phone firms overcharging customers after contracts expire, +more stories...

-

ELECTION 2020: Since 1997 the percentage of those under 55 who don't vote has doubled

Who Dares (to win them back) Wins -

EYE OPENER: The Top 1% are paying more income tax? Because their income has doubled since 1995 while the bottom 90%'s has stagnated

Half of us are borrowing to cover living costs. Since the 1980s the poorest fifth have been borrowing more and more

CARTOONS

Wednesday, 18 May 2011

Wednesday, May 18, 2011

Posted by Hari

No comments

Labels: Big Society, Bonus, executive, inequality, jobs, pay, protests, regulation, taxation

Monday, 16 May 2011

Monday, May 16, 2011

Posted by Hari

No comments

Labels: credit crunch, energy, inequality, Inflation, OFGEM, politicians, regulation, sales techniques

Sunday, 15 May 2011

Sunday, May 15, 2011

Posted by Jake

2 comments

Labels: Article, benefits, Big Society, budget cuts, credit crunch, inequality, Inflation, pensions, the government

The financial competence of Gordon Brown, the former Chancellor and Prime Minister until the ejection of the Labour government in 2010, was exposed with hindsight by his government’s failures in protecting the British economy from the Credit Crisis that started in 2008. However, the evidence of financial dizziness in the rarefied atmosphere he once sucked up was there in his earlier statements.

When, in 2008, Brown was pushing for a long-term pay settlement with public sector workers, he stated

It seemed that Brown hadn’t got to the chapter in his economics book that would have taught him: it is not only certainty on your pay that provides stability, it is certainty on the cost of your bills. To be charitable we must assume this was simply too difficult for Brown to comprehend – as the alternative would be that he was being, shall we say, misleading.

The Bank of England’s own inflation projection – its estimate of what inflation is likely to be over the next few years – shows that nobody really has much idea where inflation is going. Bank of England estimates for the next few years show inflation is likely to be anything between –0.5% and 4.5%.

Just as Labour pulled a fast one with inflation back in 2008, so are the Conservatives in 2011 with their change in the indexation of pensions from a link with the Retail Price Index (RPI) to the Consumer Price Index (CPI).

Friday, 13 May 2011

Friday, May 13, 2011

Posted by Hari

No comments

Labels: energy, Inflation, OFGEM, politicians, regulation, sales techniques, the courts

Gas

Electricity

Utility

Bills

Wednesday, 11 May 2011

Wednesday, May 11, 2011

Posted by Hari

No comments

Labels: banks, FSA, insurance, regulation, sales techniques, the courts

Chris, Fee and KJ pay their respects to the PPI victims

UK banks won't appeal ruling to compensate customers missold payment protection insurance, Lloyds to settle PPI claims, PPI: 'Banks behaved disgustingly', Coming up: Jan. PPI, housing starts, Payment protection insurance complaints still rising, US core PPI falls in Oct, largest drop in 4 yrs, Payment protection insurance sale curbs approved

Monday, 9 May 2011

Monday, May 09, 2011

Posted by Hari

No comments

Labels: banks, credit crunch, inequality, pensions, public sector, taxation, the government

Fee and KJ discuss the Greek situation, with another bailout on the horizon

Germany powers eurozone economic surge

Portugal learns terms for $115 billion bailout

Osborne: eurozone crisis shows dangers to UK

Portugal seeks EU bailout

Portugal closer to bailout

Eurozone leaders meet to bolster euro

Eurozone retail sales up for first time since July

Sunday, 8 May 2011

Is investing in the stock market all it’s cracked up to be? Judging by this rocketing graph, it would seem so. But take a closer look and you will see how you can get ripped off by investing via a “Structured Product”. The worm on the Structured Product hook is the promise that you can invest in a risky market, but if even the worst happens you are guaranteed to get your money back.

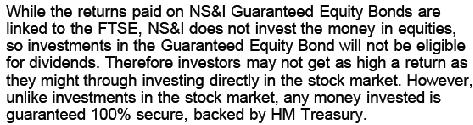

“Structured Products” are yet another method used to bamboozle the public. In the last decade there has been an avalanche of products promising returns running into the tens and hundreds of percent with minimal risk. These have included investments such as “Equity Bonds” that promise the “chilli-hot” returns of the equity markets. These come not just from known shysters like the big high street banks and building societies, but even from our own dear United Kingdom government’s NS&I (National Savings and Investments):

The agents of the Chancellor are perhaps not quite so shameless as those in the City, as NS&I haven’t been issuing these bonds since the election last year. But for the majority of us, who sometimes get a whiff of rumours that there are chilli-hot returns available from investing in shares, there are a multitude of similar rip-offs on offer from other providers.

The weasel words for this kind of bond are “may not get as high a return as they might through investing directly in the stock market” and “will not be eligible for dividends”.

Friday, 6 May 2011

Friday, May 06, 2011

Posted by Hari

No comments

Labels: banks, British Bankers Assoc, FSA, insurance, regulation, sales techniques, the courts

After a historic victory over the banks on mis-selling Payment Protection Insurance (PPI), our heroes discover why the FSA is now investigating the banks' newest idea: ID Theft Insurance

[KEYWORDS: Three million bank customers ripped off over payment protection insurance in line for payouts worth £4.5bn after High Court victory, Payment protection insurance complaints still rising

Payment protection insurance sale curbs approved, Payment protection insurance complaints soar

Lloyds stops selling payment protection insurance, Complaints over payment protection insurance on the rise, says FOS, New rules on payment protection insurance are delayed, PPI, refund, compensation, rip-off

income protection, income protection insurance, ppi, redundancy insurance, unemployment insurance, mortgage payment protection, mortgage protection insurance, mortgage protection, mortgage insurance]

Wednesday, 4 May 2011

Wednesday, May 04, 2011

Posted by Hari

No comments

Labels: budget cuts, credit crunch, elections, expense fraud, inequality, Labour, LibDems, MP, NHS, politicians, the government, Tories

Fee comes up with a novel political solution.

[KEYWORDS: UK Votes 'No' To Alternative Vote, Alternative Vote 'Would Have Kept Brown In', David Cameron ignores calls to rearrange alternative vote referendum over royal wedding date Electoral reform: The case for alternative vote Alternative Vote: the wrong referendum on the wrong question What exactly is fairer about the Alternative Vote? Would the alternative vote have changed history?]

Sunday, 1 May 2011

Sunday, May 01, 2011

Posted by Jake

No comments

Labels: Article, elections, politicians, the government

Forget whether “First Past The Post” or “Alternative Vote” is the best way for you to elect your politicians. With the imminent referendum on the voting system in the UK, politicians, journalists, activists, and even ordinary voters interested enough to have any opinion at all are focusing on the procedure of “elections”. Getting terribly heated, calling each other rotters and liars, threatening legal action for dishonesty in politics (!), they are being successfully distracted from the real issue. Not "Elections", but “Ejections”.

The question should be, “What is the most effective way to eject our politicians”. In short, “First Past The Post” is probably the most effective Ejection System for the very same reasons it is a poor Election System. Just as an MP doesn’t need more than 50% of the vote to get elected, his opponent doesn’t need more than 50% to boot him out.

Reforming the Election System is as futile as reforming the shape of clouds. Clouds form to other winds than your or my whistling. “Elections” are stitched up long before it comes to Election Day, and the stitching continues in a continuous seam long after that day. Stitched up not in the result, but in the choice.

The question should be, “What is the most effective way to eject our politicians”. In short, “First Past The Post” is probably the most effective Ejection System for the very same reasons it is a poor Election System. Just as an MP doesn’t need more than 50% of the vote to get elected, his opponent doesn’t need more than 50% to boot him out.

Reforming the Election System is as futile as reforming the shape of clouds. Clouds form to other winds than your or my whistling. “Elections” are stitched up long before it comes to Election Day, and the stitching continues in a continuous seam long after that day. Stitched up not in the result, but in the choice.

Follow Us

Search Us

Trending

Labels

advertising

Article

Austerity

Bank of England

banks

benefits

Big Society

BIJ

Bonus

Brexit

British Bankers Assoc

budget cuts

Cameron

CBI

Clegg

Comment

credit crunch

defence

education

elections

energy

environment

executive

expense fraud

FCA

FFS

FSA

Gove

Graphs

Guest

HMRC

housing

immigration

inequality

Inflation

insurance

jobs

Labour

leisure

LibDems

Liebrary

Manufacturing

media

Miliband

MP

NHS

OFCOM

Offshore

OFGEM

OFT

Osborne

outsourcing

pay

pensions

pharma

police

politicians

Poll

property

protests

public sector

Puppets

regulation

retailers

Roundup

sales techniques

series

SFO

Shares

sports

supermarkets

taxation

Telecoms

the courts

the government

tobacco

Tories

transport

TUC

UK Uncut

unions

Vince

water

© 2010-2017, Hari and Jake. All rights reserved. Powered by Blogger.