TOP STORIES

-

LATEST: Only London and the South East have recovered from the bank crash, says Bank of England director

Nor has the "jobs recovery" been a "wages recovery." Well done Cameron and Osborne -

DON'T BE FOOLED: BREXIT was about Inequality not Immigration. Why won't politicians, pundits and social media realise this?

Because blaming racists, or "unpatriotic" internationalists, is so much easier than blaming yourselves -

RIP-OFF NEWS ROUND-UP, OUR PICK OF THE LAST MONTH'S MEDIA

Paradise Papers: Queen and Bono kept money in offshore funds, leaked files reveal

Cameron's former energy minister lands top job at Russian oligarch's metals firm

UK mobile phone firms overcharging customers after contracts expire, +more stories...

-

ELECTION 2020: Since 1997 the percentage of those under 55 who don't vote has doubled

Who Dares (to win them back) Wins -

EYE OPENER: The Top 1% are paying more income tax? Because their income has doubled since 1995 while the bottom 90%'s has stagnated

Half of us are borrowing to cover living costs. Since the 1980s the poorest fifth have been borrowing more and more

CARTOONS

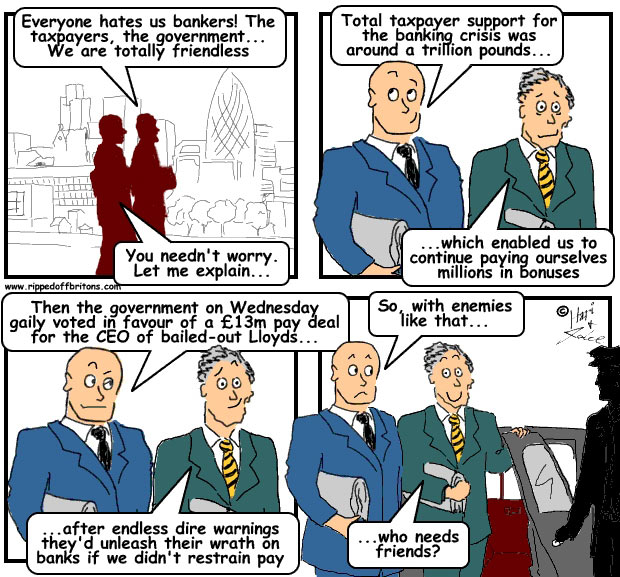

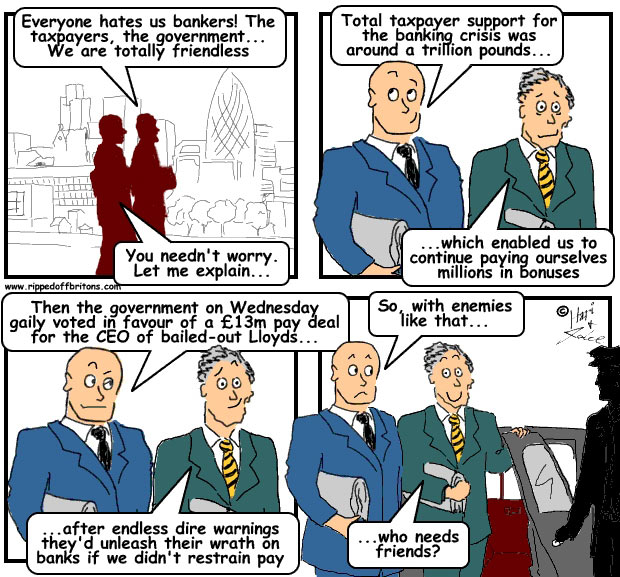

Wednesday, 29 June 2011

Monday, 27 June 2011

Monday, June 27, 2011

Posted by Hari

1 comment

Labels: banks, budget cuts, credit crunch, education, inequality, Inflation, jobs, pay, pensions, protests, public sector

Discussing austerity Britain, Chris and his wife inadvertently fan the flame of protest in their daughter

Sunday, 26 June 2011

Sunday, June 26, 2011

Posted by Jake

14 comments

Labels: Article, banks, executive, regulation, the courts

One of the stellar successes of the internet has been the Massively Multiplayer Online Role-playing Games (MMORPG). Improved internet line speeds, enhanced graphics, thick clients, multiprocessors, and games like “World of Warcraft” have contributed to multiverses of fantasy and mayhem that suck millions of people and billions of productive hours out of the real world. The great attraction of these virtual worlds is that you can take on a new incarnation. You can be what you’re not, dare what you don’t, and smoke in public places. In these worlds you are Super Sized in every way – weapons, skills, appendages - and create the sort of mayhem you only see in the movies. Perhaps the greatest attraction of these virtual worlds is that you take no responsibility for what you do. You can be reckless, you can be stupid, you can be really really bad (the sort of thing even your own mum wouldn’t forgive), and there is no comeback. Burn a village or two; kick a goblin when he is down; type really rude words that you saw someone else type. You are immortal – get “killed”, and you are back in action within seconds. And when you’ve had enough for the day, you just brush your teeth (unless you’re really pumped up with adrenalised recklessness), rub on your creams, and snuggle up in bed to dream about tomorrow’s mayhem.

A world where you can get away with what you like, destroy, lie, cheat, steal, and have to take no responsibility. Who would have thought it could be possible!

“Bank of America Corp., the No. 3 U.S. bank, was fined a record $10 million by the Securities and Exchange Commission because it lied to the regulator during a probe into trading by the bank and a former employee…….[Bank of America] neither admitted nor denied wrongdoing, and neither the bank nor the SEC named the employee whose records were at issue.”

“Morgan Stanley agreed to pay $102 million to end an investigation in Massachusetts into unfair lending practices….Under the terms of the settlement, Morgan Stanley admitted to no wrongdoing.”

“JPMorgan Chase has agreed to pay US$153.6 million (£95 million) to settle civil fraud charges that it misled buyers of complex mortgage investments just as the housing market was collapsing. JP Morgan did not admit any wrongdoing.”

“Goldman Sachs to Pay Record $550 Million to Settle SEC Charges Related to Subprime Mortgage CDO…Goldman agreed to settle the SEC's charges without admitting or denying the allegations.”

Wednesday, 22 June 2011

Wednesday, June 22, 2011

Posted by Hari

No comments

Labels: budget cuts, credit crunch, education, inequality, jobs, pay

Monday, 20 June 2011

Monday, June 20, 2011

Posted by Hari

No comments

Labels: budget cuts, credit crunch, education, Gove, inequality, pensions, politicians, protests, public sector

All politicians pretend they have more knowledge on a subject than they actually do, but one man trumps them all

Sunday, 19 June 2011

Sunday, June 19, 2011

Posted by Jake

2 comments

Labels: Article, benefits, Big Society, budget cuts, inequality, Miliband, taxation

[UPDATE OCT 2015: £13bn in benefits were unclaimed in 2013-14, according to employment minister Priti Patel. Charities say the main reasons are the complexity of the system, as well as pride and shame. The Joseph Rowntree Foundation has studied the low take up of benefits and found that lack of knowledge was often to blame. Even where people were aware that a benefit existed, often they did not know they were eligible - let alone how to claim it. Meanwhile, in communities with a strong work ethic and pride in self-reliance, people are particularly unwilling to claim benefits. And the demonisation of benefits claimants in Parliament and the media means people are too ashamed to claim the help they need - and are perfectly entitled to. A study of free school meals in Scotland, for example, found that when eligibility was briefly extended to all children in a particular age group, take-up also increased among those who had already been eligible for free school meals - because they no longer thought their children would be bullied for receiving school meals.]

Moral outrage is about something that doesn’t affect you personally. If someone pulls the leg off your teddy bear, it’s not moral outrage you are feeling – just rage. (No, really, I forgave you years ago. You know who you are!)

Moral outrage is about something that doesn’t affect you personally. If someone pulls the leg off your teddy bear, it’s not moral outrage you are feeling – just rage. (No, really, I forgave you years ago. You know who you are!)

Moral outrage is all about the principal. And is magnified more by how close the offender is to you than by the magnitude of the offence.

- Morally Outrageous: Someone who is about the same as us, same habits, same social group, doing something naughty. Outrageous because they are getting away with something we could get away with, if only we could be a bit more immoral:

- Jumping the queue

- Driving like an idiot

- Benefits fraud

- Just Damn Annoying: Someone very different to us: e.g. a celebrity, top company executive, or banker. Less outrageous, because their naughtiness is something we could only aspire to in our dreams/nightmares:

- Getting let off by the police for extreme bad behaviour, including assault and substance abuse

- Taking multi-million bonuses while wrecking the world economy

- Asset stripping companies, and throwing pensioners onto the streets

When Ed Miliband, the leader of the UK Labour Party, wanted to give his outraged morals an airing in a speech earlier this month, he picked on two sets of bogeymen.

1) A man he had met who “hadn’t been able to work since he was injured doing his job. It was a real injury, and he was obviously a good man who cared for his children. But I was convinced that there were other jobs he could do.”

2) The executives of “Southern Cross care homes - where millions were plundered over the years leaving the business vulnerable, the elderly people in their care at risk and their families feeling betrayed.”

How did a “good man who cared for his children”, claiming £71.10 a week in incapacity benefit while looking pretty fit to Miliband, find himself in the whiffy company of unashamed slash-and-burn executives who pocketed an estimated £500million at the expense of pensioners?

The sad truth is the thought of some individual scamming us taxpayers out of £71.10 per week in incapacity benefit while actually being capable of flipping hamburgers for minimum wage is enough to blow all our other troubles away. We will soon forget about Southern Cross, but the bitterness for benefits cheats will stay with us.

No matter that we can’t afford a proper armed forces or a health service, we need to hand our schools to private companies, have to work until we are older and get less pension. Misfortunes caused by avaricious bankers who were let off the leash, self-serving politicians who got rid of the leash, and incompetent regulators who wouldn’t know how to use that tricky-dicky catch on the leash even if they had a leash and the inclination to use it.

What we need to do, we are told by politicians to the left and to the right, is tighten up on the benefits system. Make sure that everyone gets just what they are entitled to, not a penny more and not a penny less.

But would tightening up save us any money? The figures show that it would actually cost us billions.

Saturday, 18 June 2011

Saturday, June 18, 2011

Posted by Jake

No comments

Labels: Article, banks, Comment, Graphs, Liebrary, taxation

Financial services companies and their bag-carriers warn of dire consequences if they were regulated and taxed more. They threaten to leave the UK, and move to more accommodating countries, and take all their corporation tax with them.

Reality: Financial services corporation tax only contributes 2% of UK tax revenues.

Corporation tax contributes less than 10% of tax revenues.

The Financial Sector, the greatest of the rippers-off of us Britons from cradle to grave, is lionised for paying 20% of all corporation tax. But 20% of 10% is a measly 2% of all tax revenues.

Reality: Financial services corporation tax only contributes 2% of UK tax revenues.

Corporation tax contributes less than 10% of tax revenues.

The Financial Sector, the greatest of the rippers-off of us Britons from cradle to grave, is lionised for paying 20% of all corporation tax. But 20% of 10% is a measly 2% of all tax revenues.

Wednesday, 15 June 2011

Wednesday, June 15, 2011

Posted by Hari

No comments

Labels: Bank of England, Cameron, credit crunch, inequality, jobs, Osborne, property, taxation, the government

Monday, 13 June 2011

Monday, June 13, 2011

Posted by Hari

No comments

Labels: Bank of England, banks, budget cuts, credit crunch, inequality, Inflation, regulation

Sunday, 12 June 2011

Sunday, June 12, 2011

Posted by Jake

No comments

Labels: Article, benefits, budget cuts, credit crunch, inequality, Inflation, pay, pensions, public sector

Getting ripped-off is not just a question of companies and governments grabbing a chunk of your assets. There is another more insidious way to make you worse off. A common thief (mugger, burglar) or a respectable company (bank, energy company, supermarket) robs you by taking your money. All very crude stuff. On the other hand, the government can rob you without laying a finger on you or on what you own.

The government is currently pulling off a massive heist on ordinary Britons using inflation:

a) changing the indexation of payments to certain categories of people including pensioners and those on benefits. Up until now, these payments have risen with the Retail Price Index. This is being changed to link to the Consumer Price Index, which will result is lower increases.

b) Putting a pay-freeze on public sector workers, who comprise just over 20% of UK workers (6.195 million people in the 4Q 2010, compared to 22.962 million in the private sector).

The cruelty of this inflation heist is that it will leave a permanent scar on its victims. Losing a few percentage points from a pension builds the growing loss into the future value of that pension forever. In contrast to this inflationary scar on ordinary Britons, the £2.5billion super-tax on the banks is more like a haircut. It grows back. And in any case, it:

a) doesn't affect the bankers, as the tax is on the bank and not on the staff

b) has to be paid by shareholders (in lower dividends) and customers (in higher charges)

c) will inevitably be stopped.

As Mervyn King, governor of the Bank of England, stated:

Inflation is just one of the ways Ripped-off Britons are being made to bear the cost of the crisis. It is the power and it is the weakness of money that it is nothing more than a token. You can do a lot of things with money. In fact, that is the entire point of money – you can do a lot of things with it. Money, after all, is the lifeblood of liquidity. The economy is ultimately based on people exchanging goods and services produced by their own labour and assets for goods and services produced by other people’s labour and assets. Money is nothing more than the token used to conduct this exchange. Nothing more, and nothing less.

If money didn’t exist, the only way a carpenter could get his teeth fixed would be by finding a dentist who happened to need some carpentering. The carpenter would build the dentist some shelves, and in return, the dentist would fix the carpenter’s teeth. The dentist too would only be able to employ those tradesmen who happened to have a toothache. All our skilled carpenters, bakers, butchers, doctors, dentists, computer programmers, and everyone else would spend virtually all their time finding a counter-party who not only needed their particular skill but could also provide the particular skill they needed in exchange. And have very little time left to use their actual skills. Imagine, if the dentist’s house was burning down and the fire truck arrived, only those firemen with bad teeth would take the trouble to fight the flames!

Saturday, 11 June 2011

We are told that the multi-million pound payments to bosses are rewards for excellence. But read the rules for the bonuses set by the remuneration committees, and you will see that many are paid for performance that is no more than better than average for their peer group. If the Olympics were run this way, the medal podium would need twenty five separate platforms.

Reality: Forget "excellence", the Lloyds Banking Group and the RBS remuneration strategy pays bonuses for better than average.

Reality: Forget "excellence", the Lloyds Banking Group and the RBS remuneration strategy pays bonuses for better than average.

Reality: According to the quarterly survey of funds for "Quarter 1 2011" by Thames River Multi Capital (TRMC) only 1.3% of funds (16 out of 1,188 funds with a three year track record) made it into the top 25% 3 years in succession.

More tragically, only 8.6% of funds did better than average three years in succession.

More tragically, only 8.6% of funds did better than average three years in succession.

Friday, 10 June 2011

Friday, June 10, 2011

Posted by Hari

No comments

Labels: advertising, FSA, insurance, regulation, sales techniques

Wednesday, 8 June 2011

Wednesday, June 08, 2011

Posted by Hari

No comments

Labels: Cameron, credit crunch, inequality, Labour, pay, politicians, taxation, the government

They might be poor, but at least they're able to measure whether they're happy with Cameron's happiness index...

Monday, 6 June 2011

Sunday, 5 June 2011

“Die Engländer gehen nach dem Prinzip vor, wenn du lügst, dann lüge gründlich, und vor allem bleibe bei dem, was du gelogen hast! Sie bleiben also bei ihren Schwindeleien, selbst auf die Gefahr hin, sich damit lächerlich zu machen.”

Joseph Goebbels, 1941

Goebbels, the World War 2 Nazi propaganda chief, knew something about lying having put in a lot of practice himself. He put it pithily: “The English follow the principal, when you lie then lie grandly, and stick to your lies! Thus they stick by their swindles even when it makes them ridiculous.” The “Big Lie”. Say it often enough, with sufficient conviction and obstinacy, and the big lie will become accepted as the truth.

Why are some lies so powerful? The reason is simple:

- People who make a living from a lie choose it carefully, practice it diligently, and work very hard at repeating it. They repeat it with a smooth unembarrassed confidence that comes from the desperate knowledge that they depend on it for their living. They hide their few lies among many truths. They despise liars, and shun them – not wanting to be judged by the company they keep. For them, it is vital that their own special lie is believed, but are otherwise honest. They are focussed on it.

- Most people who show a lie to be what it is make their point and move on. They have no long term interest in dwelling on the lie. Their triumph comes from scoring a point, rather than from suppressing the lie. For them, the lie is just something to be shot at before moving on to a fresh target.

Every now and then, there is a cheer around Britain as one of the professional fibbers is caught out red handed and sometimes red faced. To paraphrase Cole Porter's song about love: Politicians do it, bankers do it, lawyers and accountants are paid handsomely to do it on others’ behalves, even educated professors do it.

Our heroes on the Radio4 Today programme, Channel4 News, and some other worthy media outlets, chalk up a victory when they catch out and humiliate this minister, or that director, and then they move on to the sport and the weather. For the heroes, it’s a case of “so many lies to swat, so little time”. The ultimate prize for the very best of them being a gig as host on a top television quiz show. No knighthoods for the likes of the excellent John Humphrys (Mastermind) and Jeremy Paxman (University Challenge). And who even remembers that Anne Robinson (The Weakest Link) was once a fearless television and newspaper journalist.

For the villains, each has their own exceedingly small collection of fibs, which they tend and protect and put on display like the finest amateur gardeners with their prize pumpkins at a village fair.

The same ministers, directors, professors, make the same deceitful claims that they have already been caught out on. Content in the knowledge that the next interviewer probably won’t catch them out again, that most of the audience won't remember the last time they were caught out, and careless whether any of them do catch them fibbing so long as most of them don't.

Some examples of the Great Lies:

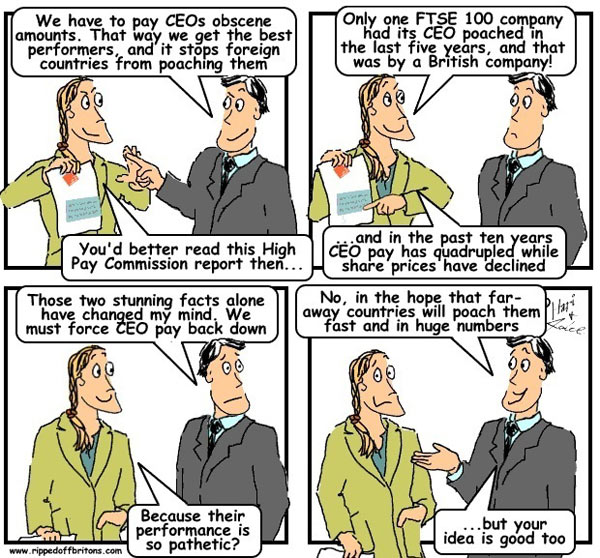

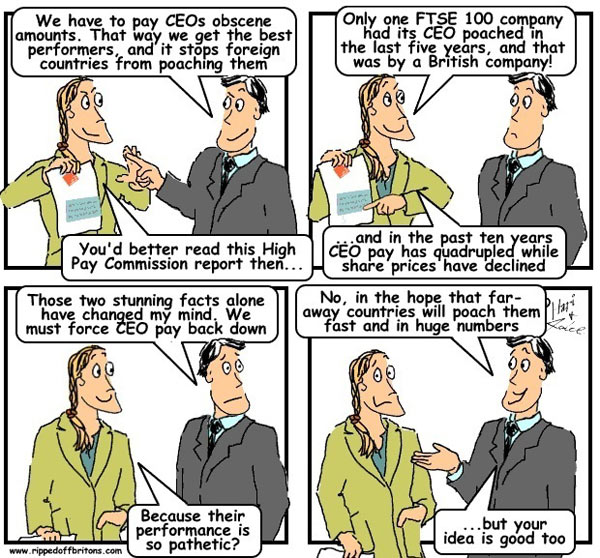

Massive pay packages reward CEOs for success

Reality: In the last ten years, the performance of companies has stagnated, while the pay of CEOs has rocketed. Graph from the High Pay Commission report:

Financial Services corporation tax makes a major contribution to overall UK tax.

Add a comment to this post, if you have a suggestion for a new topic in the Liebrary.

Alternatively, email us your ideas: liebrarySuggestion@rippedoffbritons.com

Please include your reasons, and any links to supporting evidence.

Alternatively, email us your ideas: liebrarySuggestion@rippedoffbritons.com

Please include your reasons, and any links to supporting evidence.

It is claimed by remuneration committees and pay consultants that executive pay has to keep up with international (i.e. US) levels to prevent our best bosses being poached overseas.

Reality: CEOs tend not to get poached. According to the High Pay Commission report:

"..in the last five years only one FTSE100 company has had its CEO poached by a rival, and that rival was also British.... The chance of having your CEO poached by a competitor in any one year would be 0.2%."

Reality: CEOs tend not to get poached. According to the High Pay Commission report:

"..in the last five years only one FTSE100 company has had its CEO poached by a rival, and that rival was also British.... The chance of having your CEO poached by a competitor in any one year would be 0.2%."

Reality: The High Pay Commission report shows that CEO pay has soared, while the value of their companies has stagnated.

Wednesday, 1 June 2011

Wednesday, June 01, 2011

Posted by Hari

No comments

Labels: Big Society, HMRC, inequality, pay, taxation

Follow Us

Search Us

Trending

Labels

advertising

Article

Austerity

Bank of England

banks

benefits

Big Society

BIJ

Bonus

Brexit

British Bankers Assoc

budget cuts

Cameron

CBI

Clegg

Comment

credit crunch

defence

education

elections

energy

environment

executive

expense fraud

FCA

FFS

FSA

Gove

Graphs

Guest

HMRC

housing

immigration

inequality

Inflation

insurance

jobs

Labour

leisure

LibDems

Liebrary

Manufacturing

media

Miliband

MP

NHS

OFCOM

Offshore

OFGEM

OFT

Osborne

outsourcing

pay

pensions

pharma

police

politicians

Poll

property

protests

public sector

Puppets

regulation

retailers

Roundup

sales techniques

series

SFO

Shares

sports

supermarkets

taxation

Telecoms

the courts

the government

tobacco

Tories

transport

TUC

UK Uncut

unions

Vince

water

Archive

-

▼

2011

(178)

-

▼

June

(23)

- Insurance companies in need of a painkiller

- Debt debate

- Neither admit nor deny wrongdoing - when nobody is...

- Glastonbury braced for U2 tax protests

- Numeracy skills a challenge for universities

- Gove's Law

- Benefits Fraud: would the taxpayer save money by g...

- Liebrary: Financial Services corporation tax makes...

- Beating the baggage allowance

- Googling an economic recovery

- A tale of two knights

- Inflation: How "the price of this financial crisis...

- Liebrary: Are bonuses only paid for excellent perf...

- Liebrary: Massive bonuses incentivise fund manager...

- Price comparison sites: you pay your money ...

- Happiness, happiness, the greatest gift the poor p...

- Care for the elderly

- The Ripped-Off Britons Liebrary - lies and how to ...

- Liebrary Suggestions For New Topics

- Liebrary: Massive pay packages are needed to hold ...

- Liebrary: CEO payrises are a reward for their succ...

- New Olympic event unveiled: ticket touting

- HMRC on the offensive

-

▼

June

(23)

© 2010-2017, Hari and Jake. All rights reserved. Powered by Blogger.