By Honestly Banking, undercover banker

Hooray! We the bankers of Britain will soon be getting our richly deserved Christmas Bonuses! You ripped-off Britons should be grateful. Without our bonuses, we would have already abandoned you and emigrated to Switzerland to flash our cash in the milk bars, get drizzled with premium chocolate, and ski. Competitor banks are always waving their wads under our noses. We’re not greedy. If we were greedy, we’d have gone already. Of course every silver lining has a cloud. The biggest problem with the bonus is how to spend it. A new Porsche? Mega-flat, school fees, credit card bill, something shiny from Tiffany's? And if some slackers don’t get a bonus, at least there is a free cup of coffee and some drama too (see later).

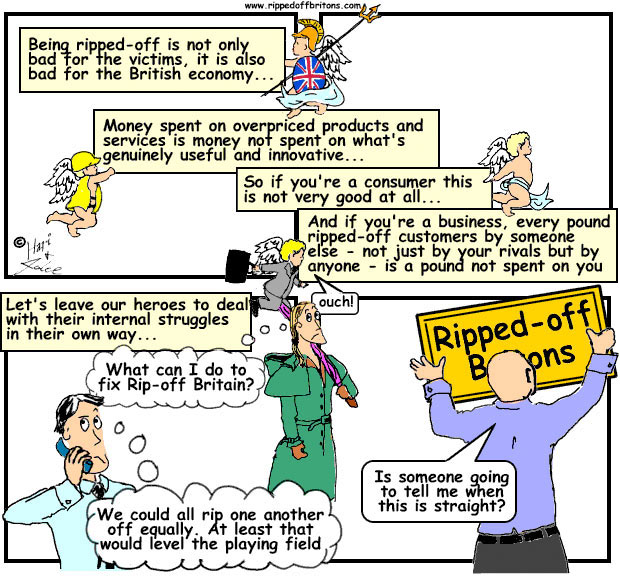

Much has been written about the bonus culture and the excesses of the banking system. How is it that in these austere times banks are making so much profit they can pay huge bonuses again? Without doubt being a banker can be one of the most lucrative jobs going. Not only is there a healthy salary, lots of fringe benefits, but also the motivation of the juicy bonus.

There are long hours and lots of stress, but there’s also a nice air conditioned office and a subsidised canteen. Not really a hardship spending long hours in this environment.

Many bankers are there for the intellectual stimulation, but really most are not there for charitable reasons or to make the world a better place – it’s all about profit.

Pay in the fancy lingo of Human Resources is known as compensation. This starts to give an insight into the motivation of workers in general and bankers in particular. Compensation in this context is payment for the bankers’ skills and time. The fixed element of a banker’s pay is the salary and the bonus is the variable part.

The salary is the agreed rate for the job. This is driven allegedly by ‘market conditions’, but it’s really about how much the banker has been able to negotiate, or in reality how much the headhunter has over sold the banker in order to increase their fee (typically up to 40% of the salary). Even better if they have negotiated a ‘guaranteed’ bonus. This means that a banker will be paid a bonus regardless of performance - nice work if you can get it!

Guarantees are used as sweeteners to aid the pain of moving from one bank to another. The reality is you may have to give up your bonus at one bank when you leave, so it’s a bribe really. Signing bonuses are another nice wheeze - new job, fancy title, a big pile of cash upfront. You don’t even need to perform for a couple of years by which time you will be ready for another move anyway! Wow, Christmas has come early!

Just as Santa is hard at work in the workshop with the elves making toys and deciding who gets them, the banks’ bonus committees are doing the same thing.

Typically the bonus committee is made up of senior bankers and departmental heads with input from HR, compliance, legal etc. It’s actually a totally pointless exercise as it will have been decided who is getting a good bonus and who isn’t. The point of all the hangers-on at this bloated meeting is firstly ‘inclusion’ - makes people feel important - and secondly to ensure that there is the appearance of a rigorous process in place.

This appearance of process is actually important. If it can’t be shown that there is rigor, the bank is leaving itself open to claims of discrimination. In fact most banks have now put some weasel words into their employment contracts about bonuses being discretionary. They also go to great lengths to emphasis the rigor of the process, but also to make it as opaque as possible. They go even further by prohibiting staff from discussing bonuses and making doing so a sackable offence.

The criteria that are really used are as follows:

· Do we want to retain them?

· Have they made us money?

These two things decide your bonus. If you’ve had a huge year but they want to get rid of you, you will get a ‘price signal’ by a small or zero bonus and thence a free cup of coffee at your ‘exit interview’. Alternately if they want to retain you, you may get a better bonus that you expected. All the other criteria, rankings, scoring systems are just smoke and mirrors and people justifying their jobs.

So what has your average banker done to earn a bonus?